Why the Arizona Housing Market Matters Right Now

The Arizona housing market crash 2026 conversation is not about panic or sudden collapse. It is about pressure building quietly in specific cities where affordability, supply, and demand no longer align.

For years, Arizona symbolized escape and affordability. Migration surged, builders expanded, and prices rose on the assumption demand would never slow. However, heading into 2026, the math behind that story is breaking down city by city.

Markets rarely fail loudly at first. Instead, they hesitate. Listings sit longer. Buyers pause. Builders slow projects without announcements. These early signals matter more than headlines.

Key Warning Signals in the Arizona Housing Market Crash 2026

Understanding the Arizona housing market crash 2026 risk starts with structure, not emotion. Several stressors are now overlapping.

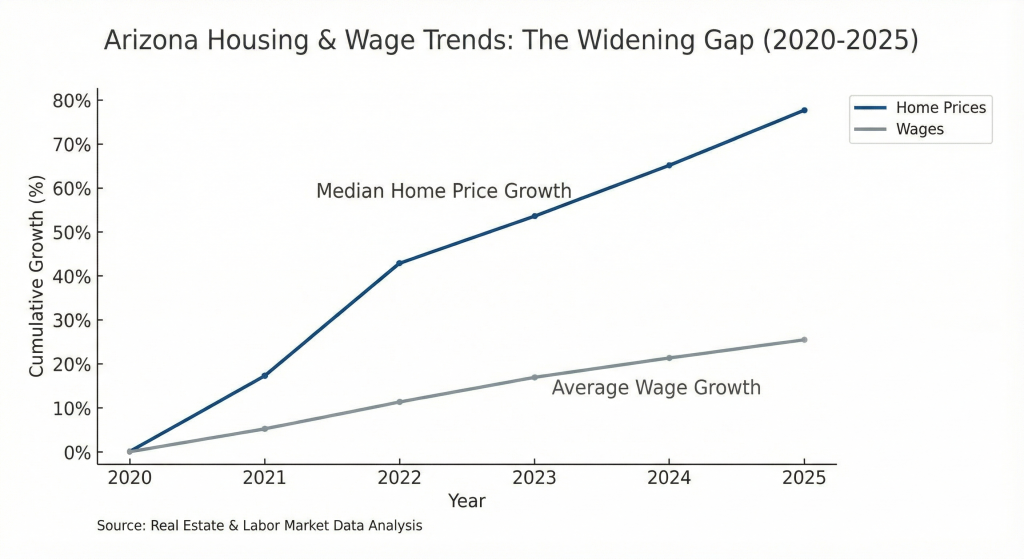

Affordability gaps widened as prices rose far faster than local wages. Once buyers stretch too far, demand does not slow gently—it disappears.

Insurance and climate costs now act like hidden rate hikes. Premiums tied to heat, fire, and water risk add hundreds to monthly costs, quietly shrinking buyer pools. FEMA risk mapping highlights these growing exposures (FEMA Flood Map Service Center).

Investor dependency amplified volatility. Short-term rentals and out-of-state capital exit quickly when returns compress, flooding markets with listings.

Migration slowdown and oversupply complete the loop. Builders continued delivering homes even as inflows cooled, pushing inventory higher across metros. This dynamic is visible in pricing and inventory data from the Redfin Data Center.

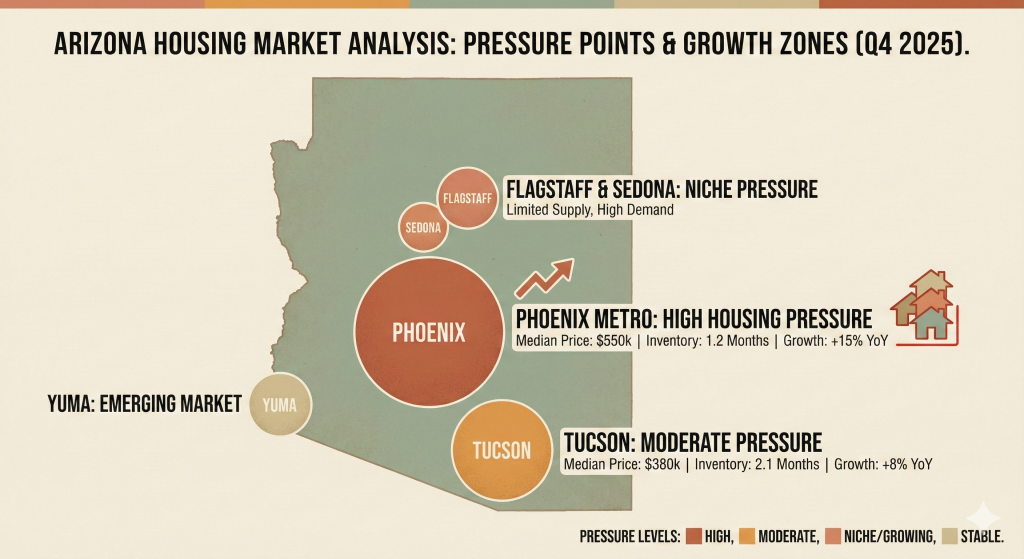

Countdown: Arizona Cities Under the Most Pressure

10 Prescott

Prescott still looks calm. However, prices outpaced what fixed incomes can support. Insurance, taxes, and maintenance quietly erode affordability. Homes linger just long enough to introduce doubt.

9 Gilbert

Gilbert remains polished, but families feel squeezed. Mortgage payments rose faster than incomes, while insurance and taxes followed. Listings now sit long enough for price cuts to feel normal.

8 Flagstaff

Flagstaff’s insulation unraveled quickly. Local wages cannot support current prices, while remote-worker demand faded. Short-term rentals sit empty longer, and sellers cling to peak pricing.

7 Tucson

Tucson’s identity as an affordable alternative is cracking. Insurance costs rose sharply, while incomes stayed modest. Investors face softer rents and tighter regulations.

6 Mesa

Mesa exposes oversupply risk clearly. Inventory stacked as momentum slowed. Insurance, HOA fees, and taxes pushed monthly costs higher, forcing price reductions.

5 Sedona

Sedona’s lifestyle immunity faded. Tourism softened, short-term rental income declined, and regulations tightened. High-end listings now linger after repeated cuts.

4 Scottsdale

Scottsdale’s luxury market is cracking. Insurance premiums, property taxes, and HOA assessments surged. Listings stretch longer, and price reductions deepen.

These cities show how confidence fades before prices collapse. Urgency disappears first. Adjustment follows.

Epicenter Cities Driving Statewide Risk

3 Chandler

Chandler’s vulnerability lies in dependency. Tech hiring slowed, and expectations reset. Inventory builds as sellers wait for a rebound that does not arrive on schedule.

2 Phoenix

Phoenix is the system. Oversupply is no longer theoretical. Migration slowed, affordability tightened, and ownership math stopped working. When Phoenix stalls, surrounding cities follow. Zillow’s Home Value Index already shows cooling momentum (Zillow Research).

1 Buckeye

Buckeye represents structural failure. Development outpaced demand. Infrastructure lagged. Migration slowed. Entire neighborhoods rose before buyers arrived.

Incentives turned into silence. Builders pulled back. Homeowners now face forced exits as carrying costs outgrow incomes. Buckeye failed mechanically, not emotionally.

What This Means for Buyers

For buyers, the Arizona housing market crash 2026 risk creates opportunity—but only with patience.

Watch local inventory relative to sales, not state averages. Monitor price reductions and days on market. Markets under pressure often overshoot on the downside.

What This Means for Sellers

Sellers face shrinking leverage. When urgency disappears, pricing must adjust. Waiting for last year’s prices often means chasing the market later.

If inventory is rising and concessions normalize, timing matters more than optimism.

What This Means for Investors

Investors should underwrite conservatively. Appreciation-driven assumptions no longer hold in many Arizona cities.

Focus on cash flow resilience, insurance risk, and exit liquidity. Markets with heavy investor share correct faster when returns compress.

For comparison, similar momentum breakdowns appeared earlier in other states, such as the slowdown detailed in why home sales are drying up in these Washington cities.

Final Takeaways

The Arizona housing market crash 2026 is not about one shock. It is about overlapping pressures quietly forcing repricing.

This analysis is educational, not financial or legal advice. Markets reward preparation, not denial.

👉 Watch the full video breakdown on our Discover the State YouTube channel to see city-by-city visuals and deeper data context.

Frequently Asked Questions

Is Arizona heading for a housing crash in 2026?

Not statewide. Risk concentrates by city where affordability, supply, and demand no longer align.

Which Arizona cities are most vulnerable in 2026?

Buckeye, Phoenix, Chandler, Scottsdale, and Mesa show the highest structural pressure.

Is it a good time to buy in Arizona in 2026?

In stressed cities, waiting may improve leverage. Monitor inventory, price cuts, and absorption closely.

What data should I watch most?

Local inventory, days on market, foreclosure filings, and insurance costs matter more than headlines.

Can Arizona recover quickly if rates fall?

Lower rates help, but they do not fix oversupply or affordability gaps. Structural issues take time to unwind.

No Comments