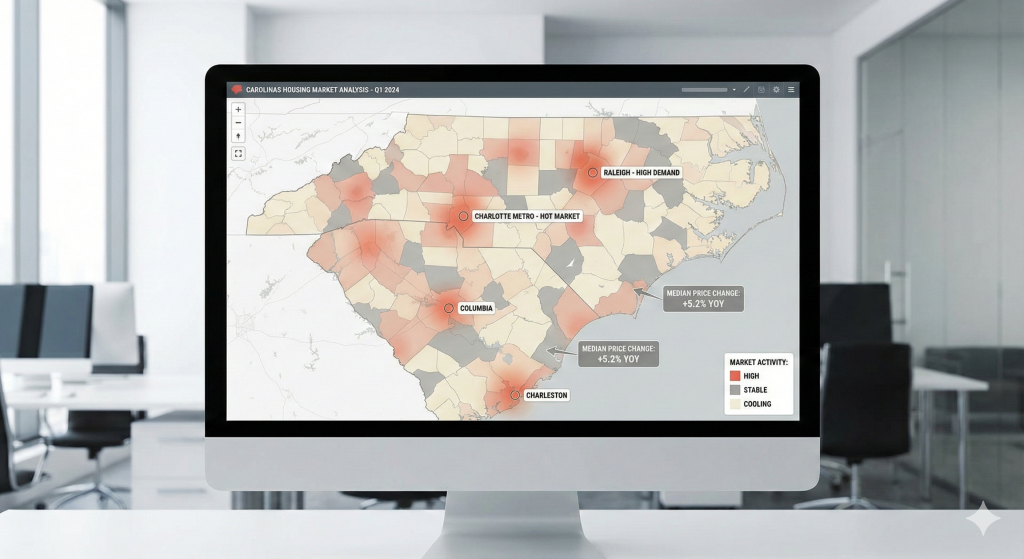

Why the Carolina cities home prices crashing right now story matters

For years, North and South Carolina were sold as housing market safe zones. Migration stayed strong. Jobs expanded. Prices rose with little resistance.

However, the data now tells a different story. The Carolina cities home prices crashing right now narrative is not about panic. It is about behavior. Buyers hesitate. Inventory builds. Sellers quietly cut prices.

Housing corrections do not begin with fear. They begin with friction. That friction is now visible across multiple Carolina markets.

Key warning signals behind the Carolina slowdown

The correction follows a familiar pattern.

First, affordability collapsed. Mortgage rates rose faster than wages. Monthly payments jumped. According to the Federal Reserve, higher rates directly reduced buyer purchasing power across rate-sensitive markets.

https://fred.stlouisfed.org

Second, inventory quietly built. Homes did not sell faster. They simply stopped moving. Redfin data shows rising active listings and longer days on market across many Southeast metros.

https://www.redfin.com/news/data-center/

Third, price cuts normalized. Small reductions became routine. Zillow’s Home Value Index shows price growth flattening and reversing in select Carolina cities.

https://www.zillow.com/research/data/

Finally, investors began exiting. When rental growth slowed and carrying costs rose, speculative demand vanished. Once investors leave, momentum flips quickly.

These signals define the Carolina cities home prices crashing right now phase.

10 Carolina cities showing clear price breakdowns

10 – Greensboro, North Carolina

Greensboro was viewed as stable and affordable. That belief is cracking. Inventory rises as homes sit longer. Price reductions are becoming common. Buyer urgency is gone.

9 – Columbia, South Carolina

Columbia relied on steady employment and rental demand. Both are weakening. Listings linger. Rental softness pushes investors away. Participation collapse defines this market.

8 – Winston-Salem, North Carolina

Remote-work optimism inflated expectations. Demand failed to keep up. Inventory surged. Buyers now negotiate instead of compete.

7 – Greenville, South Carolina

Greenville overbuilt for hype-driven demand. New construction stacked faster than buyers appeared. Builder incentives spread, eroding pricing power across the market.

6 – Asheville, North Carolina

Asheville exposes investor-heavy risk. Short-term rental math broke. Inventory jumped as investors rushed to exit. Forced selling replaced lifestyle demand.

5 – Wilmington, North Carolina

Wilmington’s coastal appeal could not offset rising insurance and ownership costs. Luxury inventory sits vacant. Price gravity is pulling values lower.

4 – Durham, North Carolina

Durham was priced for perfection. That assumption failed. Inventory climbed. Bidding wars vanished. Local wages cannot support peak prices.

3 – Charleston, South Carolina

Charleston’s charm no longer masks cost shock. Insurance, maintenance, and taxes pushed buyers away. Sellers now chase shrinking demand with deeper cuts.

2 – Raleigh, North Carolina

Raleigh shows full momentum reversal. Oversupply from aggressive building collided with affordability limits. Builder discounts now drag down resale values.

1 – Myrtle Beach, South Carolina

Myrtle Beach is the epicenter. Investor-driven demand collapsed. Condo inventory exploded. Rental income fell while HOA and insurance costs surged. This is the clearest warning sign in the Carolinas.

What this means for buyers

For buyers, leverage is returning. The Carolina cities home prices crashing right now environment rewards patience.

Focus on:

-

Rising inventory trends

-

Repeated price cuts

-

Builder incentives and concessions

As demand weakens, buyers regain negotiating power.

What this means for sellers

Sellers face a reset. Yesterday’s comps no longer apply. Waiting for a rebound may increase carrying costs.

Homes priced realistically still move. Homes priced emotionally do not.

What this means for investors

Investors must prioritize liquidity. Rental assumptions should be conservative. Insurance, HOA fees, and vacancy risk now matter more than appreciation.

FHFA data shows slower price growth in second-home-heavy regions.

https://www.fhfa.gov/DataTools/Downloads/Pages/House-Price-Index.aspx

Final takeaways on the Carolina housing shift

This is not fear. It is math.

The Carolina cities home prices crashing right now story is about oversupply, affordability limits, and investor retreat. Markets crack quietly before headlines change.

This content is educational, not financial or legal advice.

👉 Watch the full video breakdown on our Discover the State YouTube channel to see city-by-city data and updates.

Frequently Asked Questions

Is it a good time to buy in the Carolinas in 2025?

In many cities, waiting improves leverage as inventory builds and prices adjust.

How can I tell if my Carolina city is overpriced?

Watch days on market, price cuts, and inventory growth relative to local wages.

Are coastal Carolina markets riskier right now?

Yes. Insurance costs and investor exits increase downside risk.

Will Carolina home prices keep falling?

Some markets may stabilize, while oversupplied cities could continue drifting lower.

What data should I track weekly?

MLS inventory, price reductions, mortgage rates, and rental vacancy trends.

No Comments