Something has quietly shifted in Tennessee’s housing market, and you don’t need headlines to feel it. Open houses that once attracted crowds are now marked by empty driveways. Listings are languishing, not because they’re poorly marketed, but because buyers are becoming more discerning, and sellers are forced to reduce prices.

In 2025, Tennessee—once a haven for affordability—is feeling the squeeze. Rising mortgage rates, increased insurance premiums, and prices outpacing local wage growth have left buyers hesitant, and sellers scrambling to adjust. This isn’t a crash, but a market recalibration. In this article, we’ll walk through the 10 Tennessee suburbs where price cuts are accelerating, and what buyers, sellers, and investors should do to navigate this evolving landscape.

Why This Market Matters

Tennessee has long been a hotspot for in-migration, with its lower costs of living compared to states like California and New York. The rapid rise in home prices was largely fueled by this influx of buyers, attracted by affordable housing, good schools, and proximity to major job markets. However, the rapid price appreciation outpaced local wage growth, and the low-interest rate environment that once made these prices feasible is no longer in play.

The market in 2025 is adjusting, and while it may not be a sudden crash, the shifts are evident. Buyers are rethinking their options, with rising interest rates and inflation making previously affordable homes harder to justify. Sellers who once felt they could price homes based on last year’s demand are now facing the reality of a quieter market. This shift presents unique opportunities for buyers who are prepared to wait and leverage the current market dynamics.

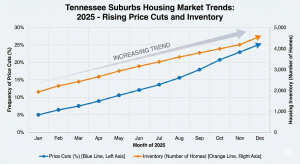

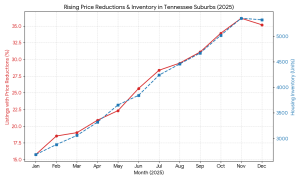

Key Warning Signals / Data Context

Several clear signals point to the ongoing market adjustments in Tennessee. Recognizing these indicators can help you understand when the market has shifted, and more importantly, when to act.

1. Price Cuts Stacking

Homes that were once priced aggressively are now experiencing multiple rounds of price reductions. These cuts are often not enough to trigger new interest, which signals that sellers are adjusting expectations to meet the new market conditions.

2. Days on Market Stretching

As demand weakens, homes are staying on the market longer. Listings that once sold within days are now lingering for weeks, even months, indicating a softening of the market.

3. Inventory Rising

More homes are available for sale, but fewer buyers are acting. The rise in inventory without corresponding demand is a strong indicator that the market is cooling off.

4. Concessions Becoming Normal

Sellers are increasingly offering concessions like closing cost assistance, rate buydowns, and flexible terms to attract buyers. These incentives are a response to weaker demand and are a clear signal that leverage has shifted to the buyer side.

These four signals—price cuts, longer days on market, rising inventory, and increasing concessions—are the key indicators that the Tennessee housing market is undergoing a significant adjustment.

10 Tennessee Suburbs Facing Price Cuts

Here’s a breakdown of the 10 Tennessee suburbs where price cuts are accelerating in 2025. These areas are where the pressure is building, and where buyers can find the most opportunities.

1. Clarksville

Clarksville has long been an affordable option for homebuyers, but in 2025, the market is showing signs of strain. While the city’s growth was once fueled by military demand and suburban expansion, price reductions are now stacking up as demand hesitates. Sellers here are testing the waters with small price cuts, but the reality is that buyers are taking their time.

2. Murfreesboro

Murfreesboro, located in the Nashville metro area, is seeing the effects of inflated pricing and slowing demand. Buyers are now more cautious, and sellers are offering concessions rather than lowering their expectations. If you’re looking to buy here, patience is key—wait for confirmation that the market is stabilizing.

3. Lebanon

Lebanon’s affordability story is beginning to unravel in 2025. Once considered an affordable alternative to Nashville, the rapid price increases here have exceeded what local incomes can support. Homes are staying on the market longer, and price cuts are becoming more frequent as sellers adjust to the new reality.

4. Mount Juliet

Mount Juliet, a once-popular suburb for commuters, is facing an influx of new listings. As homes compete with one another, the pressure to reduce prices has grown. Sellers here are responding with price cuts and incentives, but the lack of urgency from buyers signals that the market has slowed.

5. Franklin

Franklin, known for its strong schools and affluent neighborhoods, is feeling the impact of rising rates. Homes that were once priced based on peak market conditions are now sitting longer. Sellers are adjusting prices, but the disconnect between buyer expectations and reality is preventing quick sales.

What This Means for Buyers

Buyers should approach the Tennessee housing market in 2025 with patience and a strategic mindset. Here’s how to take advantage of the current market conditions:

-

Wait for Confirmation: Don’t rush into a purchase. Homes are sitting longer, and price reductions are becoming more frequent. Wait for confirmation that the market is adjusting.

-

Leverage Concessions: Sellers are offering closing cost assistance, rate buydowns, and other incentives. Use these to negotiate better terms.

-

Track Inventory Growth: Watch how inventory is rising. When sellers are slow to adjust, you have time to negotiate from a position of strength.

What This Means for Sellers

If you’re selling in Tennessee, the market is changing. Here’s how to adapt:

-

Be Prepared for Price Reductions: If your home has been on the market for a while, be ready to lower your expectations and adjust the price.

-

Offer Concessions: Incentives like closing cost help and rate buy-downs are becoming standard. Offering these can help move your listing.

-

Expect Longer Days on Market: Don’t expect quick sales. Be prepared for your home to stay on the market longer as buyers take their time.

What This Means for Investors

For investors in Tennessee, 2025 requires a more cautious approach:

-

Focus on Cash Flow: Ensure that your investments generate reliable income. Avoid speculative investments where appreciation is uncertain.

-

Understand Liquidity Risks: The market is cooling, and liquidity could become an issue. Make sure you can sell or rent your properties if necessary.

-

Look for Long-Term Opportunities: While some areas are softening, others are still stable. Invest in properties that will hold value over the long term.

Final Takeaways

The Tennessee housing market in 2025 is not collapsing, but it is undergoing a shift. Price reductions, longer days on market, rising inventory, and increasing concessions are all signs of a market correction. Buyers, sellers, and investors need to adjust their strategies to fit this new reality. By watching for signals and being patient, you can navigate the changes successfully.

For more insights into Tennessee’s housing market and other states, visit our Tennessee Housing Market Breakdown.

FAQ Section

Q1: Is it a good time to buy in Tennessee in 2025?

Yes, but buyers should be patient and wait for further price reductions. Watch for inventory to clear before committing to a purchase.

Q2: How do I know if my city is overpriced?

If homes are staying on the market longer, if there are frequent price cuts, and if inventory is rising, your city may be overpriced.

Q3: What data should I watch in Tennessee’s housing market?

Watch for price cuts, days on market, inventory levels, and the frequency of concessions. These are key indicators that the market is adjusting.

Q4: How should I approach selling in Tennessee right now?

Be prepared to lower your expectations and adjust your price. Offer incentives to attract buyers, and expect longer days on market.

Q5: Is it a good time to invest in Tennessee real estate?

Investors should be cautious and focus on properties with reliable cash flow. Avoid speculative investments and ensure liquidity in case of market changes.

No Comments