© 2025 DiscoverTheState.com. All rights reserved. Powered by DiscoverTheState.com

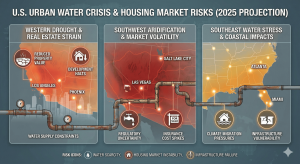

HomeState-Level Market Breakdowns10 U S Cities Where Water Shortages Could Trigger a Housing Collapse Worse Than Anyone Expected

10 U S Cities Where Water Shortages Could Trigger a Housing Collapse Worse Than Anyone Expected

Three months I’ve been buried in drought maps, aquifer data, water budgets, and insurance signals—and the takeaway is simple: the

Why the U.S. cities housing market water shortage risk 2025 matters

In 2025, we’re not just tracking mortgage rates and inflation. A deeper structural risk lurks beneath the surface of many booming metros: water scarcity. The U.S. cities housing market water shortage risk 2025 is emerging as a silent but powerful force shaping demand, building permits, and long-term value.

Water isn’t a luxury—it’s the foundation of growth. When supply can’t keep up with population and economic expansion, markets shift. Sometimes these shifts start quietly, long before prices reflect them in headlines.

Water scarcity now influences growth limits, utility costs, insurance pricing, development approvals, and buyer demand. That’s why this breakdown matters: it’s not a climate story alone—it’s a housing economic risk story.

Key warning signals / data context for water risks

Water scarcity is a measurable phenomenon. Hydrological drought—where streams, reservoirs, and groundwater fall below sustainable levels—directly threatens municipal water supplies. These conditions can restrict growth before prices adjust Drought.gov.

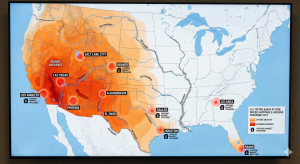

Drought risk data highlights cities like Las Vegas, San Antonio, Los Angeles, and Denver as having elevated water stress levels based on demand vs. supply ratios Redfin.

As stress increases, cities impose restrictions. Utility rates rise to fund infrastructure. Permits slow. Insurance companies tighten underwriting where water and related hazards are high. These aren’t abstract signals—they’re administrative forces that erode market liquidity.

In addition, climate projections suggest dozens of U.S. urban areas could face severe water shortages by 2030, including Phoenix and other Sun Belt markets Climate Cosmos.

The top 10 cities with water shortage housing risk

Below, each city shows how water constraints intersect with housing market fundamentals.

#10 – Orlando, Florida

At first glance, Orlando feels water-rich. But it depends heavily on aquifers under pressure from growth. Population expansion increases treatment costs, pushing utility rates higher. Rising housing expenses combined with water cost inflation can weaken demand over time.

#9 – Atlanta, Georgia

Atlanta sources most water from surface supplies like the Chattahoochee and Lake Lanier. Historical drought risk and ongoing interstate water disputes can trigger restrictions before prices soften. Expect regulatory friction influencing growth and building permits.

#8 – San Antonio, Texas

San Antonio’s Edwards Aquifer is crucial but sensitive to rainfall variability. Cities around Texas have begun pumping deeper wells and facing land subsidence risks tied to groundwater extraction, which can compromise infrastructure and long-term stability Axios.

#7 – Denver, Colorado

Denver’s reliance on snowpack and Colorado River tributaries makes its supply variable. Reduced snowpack and legal mandates for water cuts in the Colorado Basin heighten risk. Slower development approvals and higher utility costs may shape demand trends.

#6 – Salt Lake City, Utah

The shrinking Great Salt Lake infuses water risk with public health concerns. More exposed lakebed means dust with heavy metals, driving insurers and lenders to rethink risk assessments. This dynamic can thin demand and compress values in fringe markets.

#5 – Fresno, California

In the San Joaquin Valley, groundwater overuse causes subsidence that damages infrastructure and reduces aquifer storage capacity. These geologic costs translate into higher maintenance costs, insurance flags, and weaker investment interest.

#4 – Albuquerque, New Mexico

A smaller-than-expected aquifer and reliance on imported water position Albuquerque at risk of policy-driven slowdowns. Water allocation disputes mean permits can stall, slowing construction-driven economic growth.

#3 – Los Angeles, California

Los Angeles imports most of its water hundreds of miles. With California’s long-term drought and Colorado River reductions, restrictions are already normalizing. Housing approvals and affordability are increasingly tied to water allocation decisions.

#2 – Las Vegas, Nevada

Las Vegas’s dependence on Lake Mead places it near critical risk thresholds. As reservoir levels fall, costly engineering efforts maintain supply—but at a price. Higher water rates and regulatory oversight weigh on buyer and investor confidence.

#1 – Phoenix, Arizona

Phoenix leads the list because its water narrative has shifted from abundant to constrained. Arizona regulators now limit assured supply certificates essential for new subdivisions. Without these, permit approvals slow dramatically, cutting off the engine of growth and reshaping demand curves The Real Deal.

What this means for buyers

For buyers, water risk alters the housing calculus. Instead of just comparing prices, examine:

-

Where water comes from (aquifer vs. surface water vs. imported).

-

Utility rate trends and long-term cost projections.

-

Permitting trends tied to assured water supply policies.

In cities with high water stress, patience and due diligence matter more than ever. Markets may feel strong until regulatory limits bite.

What this means for sellers

Sellers in water-stressed metros should temper expectations. Premium prices assume growth continues. But when water limitations slow approvals or push up ownership costs, demand can soften quietly.

Homes may take longer to sell, and pricing power can shift to buyers who factor long-term utility costs into offers.

What this means for investors

Investors must scrutinize water risk as part of return models. Rising utility costs squeeze cash flows. Tighter permit regimes cap supply growth and may reduce future price upside.

Insurance exclusion zones or higher premiums can reduce rental yield projections. Investors who ignore this may face unexpected liquidity challenges.

Final takeaways / conclusion

The U.S. cities housing market water shortage risk 2025 is not a fear story—it’s a fundamentals story. Water scarcity reshapes utility costs, planning approvals, insurance, and lending practices long before price headlines reflect stress.

Being informed means asking the right questions:

-

What’s the long-term water source?

-

Are utility and infrastructure costs rising?

-

Are supply approvals tightening?

This is educational, not financial or legal advice. Always consult licensed professionals before buying or investing.

👉 Watch the full video breakdown on our Discover the State YouTube channel to see data maps and risk indicators city by city.

Frequently Asked Questions

Q1: How does water shortage affect home prices in 2025?

Water scarcity can shrink buyer pools, increase carrying costs, and depress demand over time in high-risk cities.

Q2: Is Phoenix’s housing market risky because of water issues?

Yes. Phoenix limits new assured water supply certificates, slowing permit growth and increasing long-term risk.

Q3: Should buyers avoid high water-risk cities in 2025?

Buyers should evaluate water sources, utility costs, and permitting outlooks before deciding.

Q4: Can rising utility costs from water shortages affect affordability?

Yes. Higher water costs raise net monthly expenses, reducing affordability and altering demand.

Q5: Do water risks impact sellers and investors differently?

Sellers may face longer listings while investors must factor water-driven utility, insurance, and regulatory risks into yield models.

Post Views: 31

No Comments