© 2025 DiscoverTheState.com. All rights reserved. Powered by DiscoverTheState.com

HomeForward-Looking Warnings & ForecastsWater Crisis 2026: These 10 Cities Are Real Estate Time Bombs

Water Crisis 2026: These 10 Cities Are Real Estate Time Bombs

You’re being sold the idea that buying a home is simple — price, location, and appreciation. But in 2026, there’s

Why Water Scarcity Is a Real Estate Risk in 2026

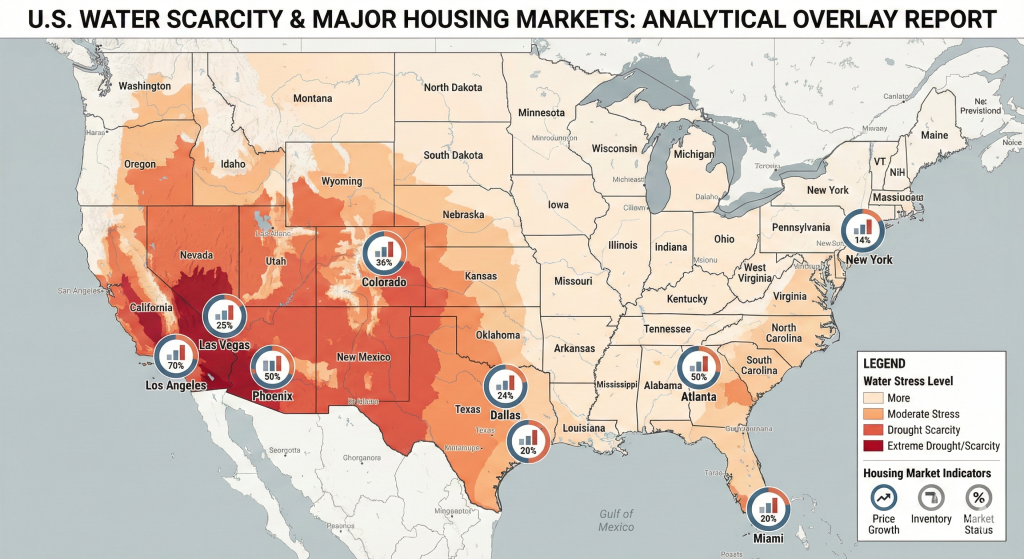

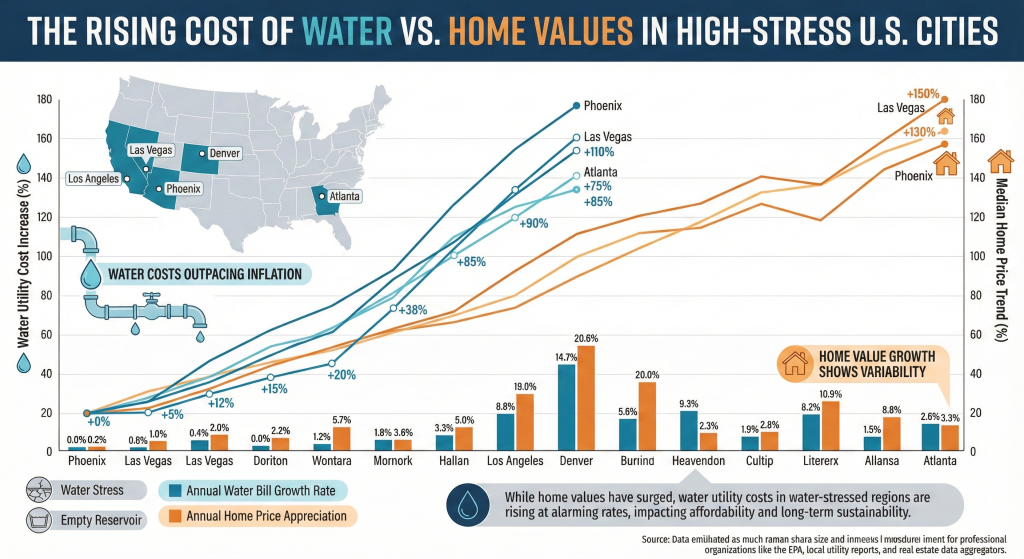

The 2026 water crisis real estate risk is not about taps running dry overnight. It’s about a hidden variable quietly reshaping U.S. housing markets — water scarcity, rising utility bills, infrastructure costs, and legal growth limits. Water influences affordability, resale demand, and long-term sustainability in ways most buyers and investors never check. Redfin+1

Across the country, homes still sell and development continues. That normalcy is exactly why the risk is overlooked. When water becomes expensive, uncertain, or legally constrained, housing markets don’t crash — they stall, soften, and slowly bleed confidence. This is the lens every homebuyer, seller, renter, and investor should add to their analysis this year.

How Water Stress Quietly Affects Housing Markets

Water scarcity enters the housing equation indirectly — not through headlines but through everyday costs and constraints:

-

Monthly utility cost escalation: When infrastructure and supply become expensive, water rates and taxes rise, effectively increasing the cost of ownership beyond mortgage payments. Forbes

-

Infrastructure pressure: Treatment plants, desalination, and long-haul imports carry capital costs passed to residents as fees, assessments, and rate hikes. Redfin

-

Legal growth limits: Regulators may limit development when supply cannot keep up, slowing new home construction and reducing market liquidity. Redfin

-

Behavioral hesitation: Buyers start asking different questions — not just price and location but system sustainability. This hesitation slows demand before prices adjust. Redfin

10 Cities Facing Water-Linked Real Estate Pressure

Southern California & Southwest

Los Angeles, California

Los Angeles relies heavily on imported water from distant sources under stress. Costs and rate hikes quietly weigh on long-term affordability, affecting who can afford homes and the pace of market activity. Redfin

San Diego, California

At the edge of water pipelines, San Diego uses costly desalination and imports most of its water. That dependency raises utility bills and insurance costs tied to drought and fire risk, moderating buyer enthusiasm. Redfin

Texas & Desert South

San Antonio, Texas

San Antonio’s explosive growth leans heavily on a single aquifer. Continued pressure increases restrictions and utilities costs, making affordability appear better on paper than in long-term cost forecasts. Redfin

El Paso, Texas

El Paso uses advanced reuse and desalination but at a cost. These engineered solutions make water secure, yet they increase bills and household expenses over time, shaping affordability quietly. Redfin

Mountain West

Salt Lake City, Utah

Nearby, the Great Salt Lake’s decline signals environmental strain. Shrinking water sources and air quality issues can dampen market confidence and change livability calculations. Redfin

Desert Southwest

Las Vegas, Nevada

Las Vegas operates near the limits of its Colorado River allotment. Conservation is high, yet no margin remains for additional stress, creating fragility rather than resilience. Redfin

Phoenix, Arizona

Phoenix has faced legal caps on new development due to limited groundwater. When growth slows by policy, long-term appreciation assumptions change. Climate X

Florida & East Coast

Cape Coral, Florida

Built around shallow aquifers, Cape Coral now grapples with saltwater intrusion and expensive reverse osmosis treatment. These costs filter into water bills and insurance premiums, influencing buyer decisions. The Wall Street Journal

Sunbelt & Luxury Markets

Scottsdale, Arizona

Scottsdale’s water rights stability masks political prioritization that can deepen inequality and risk, especially if scarcity intensifies under stress. Redfin

New Jersey (Statewide)

While not drought-prone, New Jersey’s aging water infrastructure and flood risk create financial burdens that raise utility, taxes, and insurance costs — subtly eroding affordability. PreventionWeb

What This Means for Buyers

Buyers should integrate water risk into their due diligence. Beyond price and neighborhood, ask:

-

Where does water come from?

-

How secure and redundant is the source?

-

What are projected rate increases?

-

Are growth permits tied to water availability?

Balancing mortgage costs with lifetime utility expenses is essential for a realistic affordability forecast.

What This Means for Sellers

Sellers in water-strained markets can’t assume growth narratives alone support pricing. Highlighting resiliency investments, water source security, and cost forecasts can differentiate listings and set realistic buyer expectations.

What This Means for Investors

Investors need to price in water-linked costs and demand slowdowns. Markets with legal growth ceilings or rising utility burdens may see lower turnover, longer days on market, and higher holding costs. Investors should consider long-term trends over short-term yields.

Data and Broader Context

Water scarcity isn’t an isolated environmental issue. Redfin’s drought risk data shows cities across the Southwest and West with high water stress projections — a basic supply vs. demand measure that correlates with real estate hesitancy. Redfin

Financial analysts now view water insecurity as a systemic risk affecting cost structures and demand patterns. Forbes

Internal Links

For deeper context on affordability and risk trends, see these relevant insights:

-

Our analysis of Top 10 Worst Cities to Buy a Home in California in 2026 — where water and climate risks intersect with pricing. Discover The Estate

-

A recent 2026 Housing Collapse: 10 U S Cities Where Home Values Are Crashing Fast that highlights markets under multiple pressures. Discover The Estate

-

Our Guide to US cities where rent is collapsing in 2026 — rental dynamics often precede price pressure. Discover The Estate

Final Takeaways

The 2026 water crisis real estate risk is subtle but real. It reshapes costs, confidence, and growth assumptions without dramatic headlines. Smart homebuyers, sellers, and investors think in terms of sustainability, not just speculation.

Understanding water scarcity as a market variable transforms your analysis from wishful thinking to realistic evaluation.

Watch the full video breakdown on our Discover the State YouTube channel for a city-by-city visual guide.

FAQ

Q: What is the 2026 water crisis real estate risk?

A: It’s the hidden impact of water scarcity on housing costs, utility bills, growth limits, and market confidence that shapes affordability and demand without overt shortages. Redfin

Q: How can water scarcity affect home prices?

A: Higher utility costs, infrastructure fees, and legal development caps reduce demand and slow price growth even without dramatic market downturns. Forbes

Q: Is it a good time to buy in water-stress cities in 2026?

A: It depends on your risk tolerance and long-term outlook. Evaluate water security, projected cost increases, and resilience plans alongside prices.

Q: Which markets are most exposed to water risk in 2026?

A: Southwestern and coastal cities like Los Angeles, San Diego, Phoenix, Las Vegas, and Cape Coral show higher exposure due to supply limits and cost trends. Redfin

Q: Should investors avoid these cities entirely?

A: Not necessarily. Some markets may still offer opportunities, but require careful pricing of water-linked costs and demand patterns over decades.

Post Views: 24

No Comments