Why the 2026 housing market matters

The 2026 housing crash cities story is not about a national collapse. On the surface, national housing data still looks stable. Prices appear to be holding, and transaction volume has not imploded.

However, this calm is misleading.

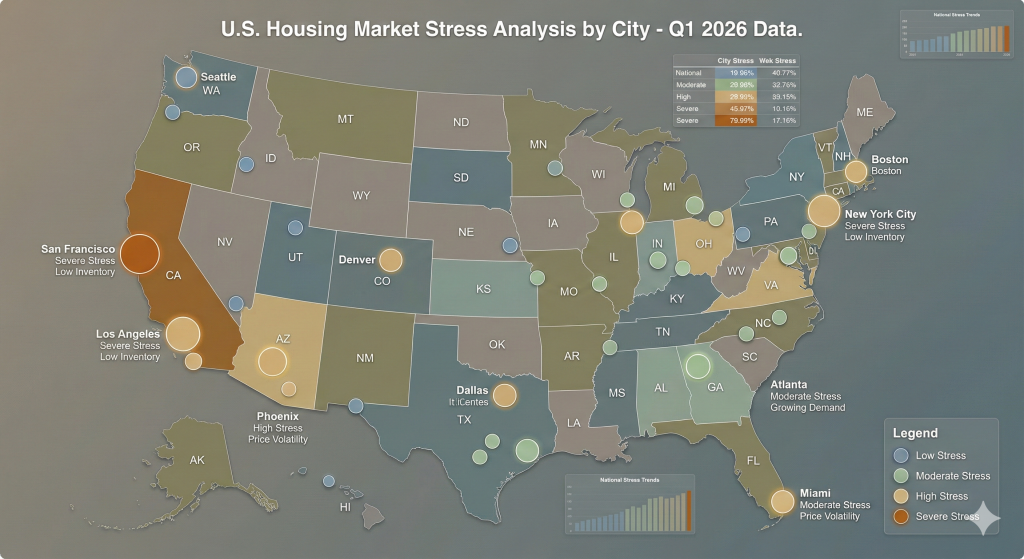

Housing markets do not fail all at once. They fracture locally, city by city, long before national averages reflect stress. In 2026, the breakdown is already visible in stalled demand, rising ownership costs, and shifting buyer psychology.

This matters because people make decisions locally, not nationally. If you buy or sell based on averages, you often react too late.

Key warning signals behind the 2026 housing crash cities

Every market on this list shows the same structural signals, even though the causes differ.

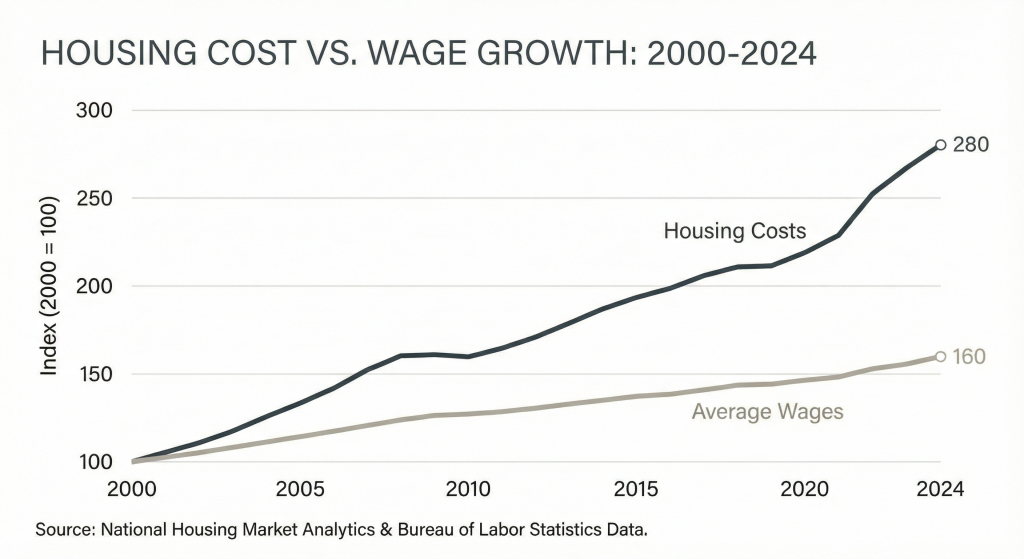

First, affordability compression. Prices rose faster than incomes for too long. Demand did not vanish, but it became fragile. When rates and costs rose, that fragile demand stepped back.

Second, ownership cost stacking. Mortgage payments are only part of the equation. Taxes, insurance, HOA fees, and maintenance kept rising. Together, they priced out the next buyer.

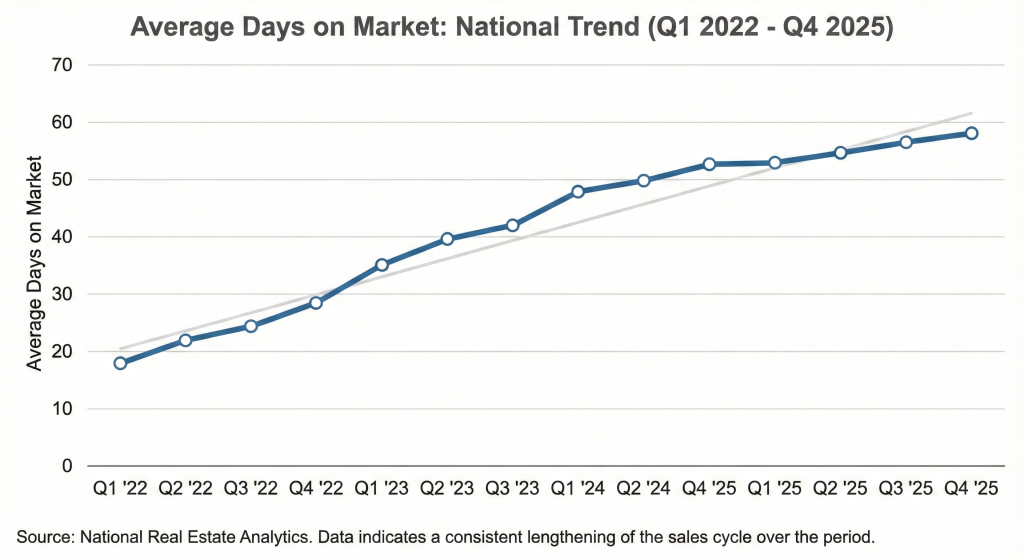

Third, inventory absorption failure. This is not massive oversupply. It is homes listing faster than qualified buyers can absorb them. As a result, listings linger and price cuts normalize.

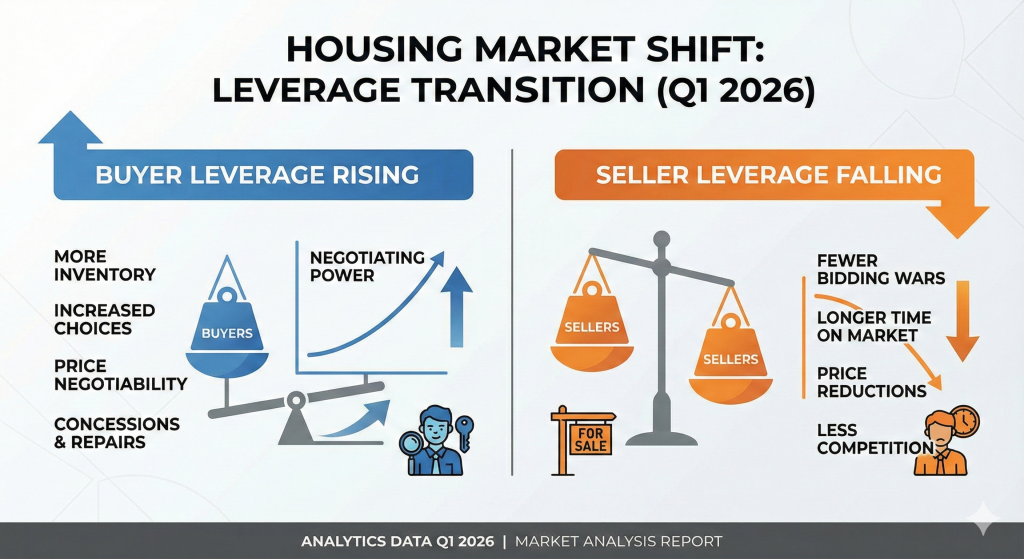

Finally, buyer psychology reversed. Fear of missing out has been replaced by fear of being stuck. When waiting feels safe, urgency disappears.

Data from the Zillow Home Value Index and the Redfin Data Center confirms these patterns across multiple regions.

2026 housing crash cities: the breakdown

10. Birmingham, Alabama

Birmingham appears insulated at first glance. Prices remain below national averages, and speculation was limited during the boom.

That is precisely the problem.

This market relies on steady participation to function. Buyers here are highly payment-sensitive. Even modest increases in rates or insurance thin demand quickly. Zillow data shows longer days on market and quiet price reductions.

The result is not a crash, but a slow bleed that steadily resets expectations lower.

9. Memphis, Tennessee

Memphis rode the national housing wave without the income growth to support it. Prices rose faster than wages, driven largely by investor demand.

In 2026, investors are pulling back as rents soften and financing costs rise. Owner-occupant demand has not replaced them. Stagnation has taken hold, and buyer hesitation is freezing momentum.

We have seen similar dynamics before in our breakdown of the

Illinois housing market crash risk.

8. Toledo, Ohio

Toledo illustrates a Midwest pattern many miss. Prices accelerated without population growth to support them.

As rates normalized, demand slowed faster than sellers expected. Listings linger, especially at the entry level. Buyers see inventory and know sellers are adjusting, making patience rational.

7. St. Louis, Missouri

St. Louis long benefited from a reputation for stability. In 2026, that stability is turning into gravity.

Prices rose during the boom, but incomes did not follow. Buyers are now running full ownership math instead of assuming appreciation. Inventory is building in key neighborhoods, and sellers are stuck between waiting and adjusting.

6. Phoenix, Arizona

Phoenix magnifies stress through scale. Rapid growth masked structural limits during the boom.

Now, inventory has risen sharply in newer subdivisions. Builders are offering incentives instead of cutting prices. Buyer urgency has vanished. Phoenix is not collapsing, but it is recalibrating in public view.

We explored similar Sun Belt pressure in

Arizona cities where prices are falling.

5. Tampa, Florida

Tampa shows how lifestyle markets crack under cost pressure. Migration drove prices higher, but insurance premiums, taxes, and HOA fees are reshaping affordability.

Homes still sell, but only when priced realistically. Emotion has been replaced by spreadsheets.

This mirrors trends discussed in our analysis of

Florida housing markets losing momentum.

4. Las Vegas, Nevada

Las Vegas faces a different kind of constraint. Efficiency has removed waste but created no margin. Nearly all water comes from a single strained system.

Markets operating without slack are fragile. Buyers sense this. They hesitate. That hesitation is destabilizing for a market that relies on constant inflow.

3. Scottsdale, Arizona

Scottsdale is a market built on exclusivity, not abundance. Strong water rights protect the city, but that protection is conditional.

Rising infrastructure costs and long-term sustainability concerns narrow demand over time. Wealth delays consequences, but it does not erase them.

2. Phoenix, Arizona (Structural Ceiling)

State regulators halted new development approvals in groundwater-dependent areas after confirming long-term supply limits. That ruling permanently changed the growth equation.

Housing appreciation depends on expansion. When future growth is constrained by law, confidence erodes quietly.

1. New Jersey

New Jersey tops the list of 2026 housing crash cities because multiple pressures converge at once.

High taxes, aging infrastructure, pension obligations, and population outflow leave no buffer. Housing absorbs this first. Buyers slow, sellers resist, and confidence drains.

This is not panic. It is math finally asserting itself.

What this means for buyers

For buyers, 2026 is about patience and discipline. Negotiation power has returned in many of these cities.

Focus on total ownership cost, not list price. Watch days on market, inventory growth, and price reductions before making offers.

What this means for sellers

For sellers, realism matters more than optimism. Holding costs do not pause while listings sit.

Pricing early and accurately often preserves more value than waiting for conditions that may not return.

What this means for investors

For investors, momentum strategies are fragile in 2026. Cash flow, cost predictability, and long-term demand matter more than appreciation narratives.

Markets facing structural limits deserve higher risk premiums or avoidance altogether.

Final takeaways on the 2026 housing crash cities

The 2026 housing market is not crashing everywhere. It is fragmenting.

Cities where prices, costs, incomes, and expectations stopped moving together are adjusting first. These adjustments happen quietly, but they lock in outcomes early.

This content is for educational purposes only and not financial or legal advice.

For the full visual breakdown, watch the full video on our Discover the State YouTube channel.

FAQ: 2026 housing crash cities

Is there a nationwide housing crash in 2026?

No. The 2026 housing crash cities reflect localized breakdowns, not a national collapse.

How do I know if my city is at risk in 2026?

Watch affordability, days on market, inventory growth, and ownership costs relative to incomes.

Is it a good time to buy in 2026 housing crash cities?

For patient buyers, yes. Negotiation power has improved where demand has stalled.

What data should buyers and investors track most?

Zillow Home Value Index, Redfin inventory trends, mortgage rates from the

Federal Reserve, and local insurance costs.

Are these cities permanently broken?

Not necessarily. However, markets with structural limits tend to stagnate or reprice over longer periods rather than rebound quickly.

No Comments