Intro: Why this market matters

The Arizona housing market 2025 doesn’t feel “broken.” It feels off. The desert still sells itself. However, the buyer behaviour has changed.

Open houses that used to feel like airports now feel like waiting rooms. In addition, the listing language is telling on itself: “price improvement,” “motivated seller,” and credits that used to be rare.

This is not a crash call. It’s a repricing cycle you can see in the tape.

Key warning signals in the Arizona housing market 2025

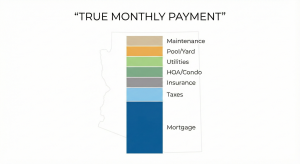

When a boom ends, it usually ends the same way: the monthly payment outruns the paycheck.

In Arizona, the affordability stack is not just mortgage principal and interest. It’s also taxes, insurance, HOA/condo fees, utilities, pool care, landscaping, and desert-climate repairs. As a result, buyers start acting like underwriters.

Here are the signals to watch in your ZIP code:

-

Days on market rising compared to last year.

-

List-to-sale ratios softening toward, or below, 100%.

-

Repeat reductions on the same address (cut… then cut again).

-

Inventory building quietly, instead of clearing weekly.

-

More contracts failing at inspection, appraisal, or financing.

If you want clean benchmarks, use the Redfin Data Center for market trend context and Zillow’s datasets for home value and market-change series. (https://www.redfin.com/news/data-center/) <!– :contentReference[oaicite:0]{index=0} –> (https://www.zillow.com/research/data/) <!– :contentReference[oaicite:1]{index=1} –>

Meanwhile, track the rate environment through Freddie Mac’s PMMS and the FRED 30-year series, because the “monthly” is rate-sensitive even when prices stall. (https://www.freddiemac.com/pmms) <!– :contentReference[oaicite:2]{index=2} –> (https://fred.stlouisfed.org/series/MORTGAGE30US) <!– :contentReference[oaicite:3]{index=3} –>

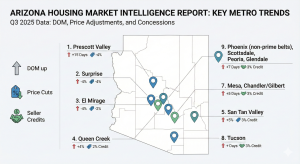

9-city breakdown: Where the boom is clearly over

We’re starting in the “obvious if you live there” markets, then moving into the areas Arizona assumed would stay insulated.

9) Prescott Valley (and Prescott fringes)

Prescott Valley sold a lifestyle promise: cooler nights, slower pace, views, and golf energy. Prices sprinted ahead of local wages during the boom. Now the same 1990s and 2000s homes sit longer.

Fixed-income and lifestyle buyers are more payment-sensitive than people think. Therefore, small rate shifts can change demand quickly here.

What to watch: longer DOM on view homes that aren’t turnkey, and reductions on dated interiors.

8) Surprise + El Mirage

The West Valley value pitch runs into a simple constraint: operating costs plus a higher mortgage. Commutes, utilities, and builder-tract sameness make buyers more selective.

In 2025, demand doesn’t disappear. It gets picky. As a result, concessions whisper instead of bidding wars shouting.

What to watch: builder incentives, closing-cost credits, and resale listings matching incentives to compete.

7) Queen Creek + San Tan Valley

This was the exurb dream: bigger houses in exchange for more freeway time. In 2025, long drives plus gas, taxes, and insurance push stretched buyers into “maybe not.”

When the marginal buyer steps back, the whole subdivision feels it. Therefore, look-alike tracts can show clustered cuts.

What to watch: multiple similar homes reducing in the same two-week window.

6) Peoria + Glendale belts

Larger homes often mean larger monthly obligations. Utilities, maintenance, and insurance stack up fast. Wages didn’t scale at the same speed as boom pricing.

Buyers are still shopping, but they’re underwriting the home like a long-term expense. That changes the negotiation posture.

What to watch: buyers pushing back on roofs, HVAC, and energy efficiency.

5) Mesa

Mesa is the workhorse market. It has families, retirees, students, and light-rail commuters. The pitch used to be simple: solid homes at doable prices.

After the run-up, buyers now mentally add roof age, A/C life, water heaters, and utility costs before they accept the list price. As a result, “updated in 2008” doesn’t clear at 2022 numbers.

What to watch: “first cut by week two,” followed by a second cut if showings don’t convert.

4) Chandler + Gilbert

Chandler and Gilbert were the East Valley “safe middle” story: jobs, schools, and manicured HOAs. The brand is still strong. However, the ledger is heavier.

HOA dues, taxes, daycare, car payments, and a jumbo-ish payment stack turn hesitation into behaviour. Therefore, nearly identical homes in 2000s subdivisions start flashing reductions at the same time.

What to watch: reductions clustered across similar floorplans, plus sellers offering rate buydowns.

3) Tucson

Tucson has its own rhythm, but it’s not immune to the “monthly” constraint. Belts that absorbed remote workers and investor demand now see tougher inspection outcomes and more under-ask negotiation.

Investors are also stricter. They want cash flow, not hope. As a result, deals die faster when rents can’t justify the payment.

What to watch: inspection blowups, relists, and price adjustments after failed pendings.

2) Phoenix non-prime belts

This is where the hangover becomes visible. These are areas that rode waves of investors and first-time buyers when money was cheap.

In 2025, days on market stretch, cuts feel routine, and concessions become standard operating procedure. Service and mid-income households carrying 2022 payments start feeling pressure. Therefore, sellers become more flexible.

What to watch: seller-paid credits, rate buydowns, and “back on market” listings with improved terms.

1) Scottsdale (repricing in public)

This is the line Arizona never expected to cross. Scottsdale was the “doesn’t lose” narrative: golf, status, nightlife, lock-and-leave condos, and premium demand.

Now the monthly is harder to hide. Jumbo loans, HOA dues, taxes, insurance, and choppy tourism math for STR-style buyers create friction. As a result, inventory can stack in certain condo and townhome corridors, and incentives appear where they used to feel unnecessary.

What to watch: longer DOM on luxury-adjacent listings, and incentive packages replacing “best and final.”

If you want a closely related Arizona read, see our breakdown of where demand has already weakened across the state: Top 10 Cities in Arizona Where Buyer Demand Has Collapsed in 2025 <!– :contentReference[oaicite:4]{index=4} –>

What this means for buyers

Your edge in 2025 is not speed. It’s structure.

-

Build a watchlist of homes sitting 30–45+ days, especially after a second cut.

-

Treat list price as a starting position, not a command.

-

Keep inspection and financing protections. Then negotiate with the report.

-

Ask for repair credits, closing cost help, or a permanent buydown.

-

Run a five-year monthly: mortgage + taxes + insurance + HOA + utilities + maintenance versus realistic rent.

If the deal only works after financial gymnastics, it doesn’t work yet.

For broader context, here’s how inventory growth and buyer hesitation is showing up across multiple states: Top 10 States Where Housing Inventory Is Up but Buyers Are Gone <!– :contentReference[oaicite:5]{index=5} –>

What this means for sellers

In this phase, you are not competing with 2021 screenshots. You are competing with today’s active inventory.

-

Price to closed and pending deals, not peak comps.

-

Consider a pre-inspection to control the narrative and reduce renegotiation risk.

-

Lead with a clean incentive package (credit + buydown) instead of slow-motion cuts.

-

De-risk objections upfront: roof age, HVAC, HOA details, and true operating costs.

You’re not just selling a house. You’re selling a payment.

What this means for investors

The 2020–2022 playbook was appreciation-first. The 2025 playbook is cash-flow discipline.

-

Underwrite conservatively on insurance, HOA dues, and maintenance.

-

Stress-test vacancy and rent assumptions. Then stress-test again.

-

Avoid thin-margin buys where one repair wipes out the year.

-

Use FHFA HPI as a long-run context tool, not a timing signal. (https://www.fhfa.gov/data/hpi) <!– :contentReference[oaicite:6]{index=6} –>

If you want to compare Arizona’s “desert boom hangover” to nearby markets, these are strong parallels:

-

Nevada Housing Meltdown – 10 Desert Cities Drowning in Price Cuts <!– :contentReference[oaicite:7]{index=7} –>

-

Utah Real Estate Crash: Top 10 Overpriced Cities Locals Can’t Afford <!– :contentReference[oaicite:8]{index=8} –>

-

California Cities Home Prices Fall in 2025: Top 10 Cities <!– :contentReference[oaicite:9]{index=9} –>

Final takeaways / conclusion

Arizona isn’t “over.” It’s being repriced.

The Arizona housing market 2025 is shifting because the payment changed faster than incomes and rent math. Therefore, leverage is moving toward calm buyers, realistic sellers, and disciplined investors.

This is educational content, not financial, legal, or investment advice. Always verify numbers for your city and consult licensed professionals.

Watch the full video breakdown on our Discover the State YouTube channel.

FAQ

Is the Arizona housing market 2025 crashing or just cooling?

In most areas, it looks like a repricing cycle, not an instant crash. The tell is behaviour: DOM up, cuts stacking, concessions returning, and more failed pendings.

Is it a good time to buy in Arizona in 2025?

It can be, if the monthly works without stretching. Focus on 30–45+ DOM listings, negotiate credits, and run a five-year monthly comparison versus rent.

How do I know if my Arizona city is overpriced right now?

If similar homes keep cutting price, sit past two weekends, or require incentives to move, buyers are signalling resistance. Compare actives to recent pendings, not peak comps.

What data should I watch for the Arizona housing market 2025?

Track DOM, price-cut frequency, sale-to-list ratios, and mortgage rates. Start with Redfin Data Center and Zillow’s data tools, then sanity-check rate trends via Freddie Mac and FRED. (https://www.redfin.com/news/data-center/) <!– :contentReference[oaicite:10]{index=10} –> (https://www.zillow.com/research/data/) <!– :contentReference[oaicite:11]{index=11} –> (https://www.freddiemac.com/pmms) <!– :contentReference[oaicite:12]{index=12} –> (https://fred.stlouisfed.org/series/MORTGAGE30US) <!– :contentReference[oaicite:13]{index=13} –>

What should sellers do if showings are slow in Arizona in 2025?

Reset pricing to today’s pendings, reduce inspection risk with a pre-inspection, and offer a clean incentive package. Small cosmetic tweaks won’t overcome a bad monthly.

No Comments