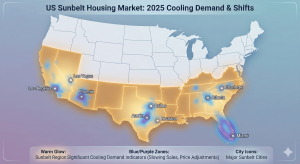

The U.S. housing market in 2025 is telling a different story for the once-booming Sunbelt cities. What once felt like an unstoppable growth engine is now showing signs of cooling demand. From reduced open houses to vacant new builds, these shifts are subtle yet significant.

In this article, we’ll analyze how demand is slowly evaporating in these Sunbelt cities. We’ll walk through the key indicators you should watch for if you’re buying, selling, or investing in these areas. Understanding this transformation is crucial to making informed decisions, whether you’re relocating, buying a second home, or adjusting your investment strategy.

Why This Market Matters

For years, the Sunbelt was synonymous with rapid growth and migration. As people left expensive coastal cities for more affordable options, the Sunbelt became the go-to destination for homebuyers seeking more space and lower living costs. However, as we enter 2025, the dynamic is shifting.

What does this mean for the U.S. housing market? It means a slowdown, not a crash, but one that could have profound impacts on buyers, sellers, and investors. The Sunbelt’s booming growth was fueled by cheap money, remote work, and relocation hype—but with interest rates up and other costs rising, the allure of these cities is starting to fade.

Key Warning Signals and Data Context

Several signs point to a changing market in the Sunbelt. Here’s what to look for:

-

Days on market: Homes that would have sold in days are now lingering for weeks or even months.

-

Price cuts: Listings that start with high expectations now show frequent price reductions.

-

Builder incentives: Offers like rate buydowns and closing-cost credits are becoming standard, not just attractive bonuses.

-

Vacancy: New builds and rental properties are seeing higher vacancy rates, with owners holding out for last year’s rents while the market has shifted.

These early signs of cooling demand are happening across several cities. Let’s break down what’s happening in specific areas.

Countdown: 10 Sunbelt Cities Facing Cooling Demand

1. Overbuilt Master-Planned Communities

These cities saw explosive growth with expansive, identical homes in master-planned communities. The boom has now slowed, leaving partially occupied cul-de-sacs and dark model homes. Buyers once lined up for these homes, but now builders are offering rate buydowns and other incentives to move inventory.

2. Investor Street Cities

In many Sunbelt metros, entire streets were bought up by investment firms looking for rental income. Now, these properties sit vacant longer between tenants, with owners unwilling to lower rents to match the market.

3. Heat and Insurance Squeeze Cities

Insurance premiums in some Sunbelt cities have skyrocketed, especially in regions at higher risk for weather-related disasters. Meanwhile, property taxes and utility costs are rising, making these once affordable areas much more expensive for buyers.

4. Commute-Drag Cities

These cities were once attractive for people looking to work remotely and move farther from urban centers. But with the return of in-person work and rising gas prices, the long commutes are no longer worth the trade-off for extra space.

What This Means for Buyers

For buyers, the shift in the Sunbelt offers new opportunities, but also new risks. If you’re looking to buy in these cities, here’s what you need to keep in mind:

-

Watch for long days on market: Homes that linger for weeks or months could be negotiable. Prices may be reduced, but sellers will be more flexible.

-

Focus on value, not just location: Ensure that the home you’re considering is still a good deal when factoring in higher carrying costs.

-

Leverage concessions: Builders and sellers are offering closing-cost help and rate buydowns—don’t be afraid to negotiate for these.

What This Means for Sellers

For sellers in these cities, it’s important to adjust your expectations. The once-booming markets are now cooling, and pricing strategies need to evolve. Here’s what you should consider:

-

Be realistic with pricing: Don’t expect to get the prices you would have during the peak of the market. Pricing too high will leave your property sitting for too long.

-

Offer incentives: Providing buyers with closing-cost credits or rate buydowns could help attract serious offers in a slow market.

What This Means for Investors

Investors need to rethink their strategies in these Sunbelt cities. Once considered surefire bets, these markets are now showing signs of cooling. Here’s how to proceed:

-

Focus on cash flow: Ensure that your investments are generating reliable income, not just speculative growth.

-

Reevaluate appreciation assumptions: The aggressive appreciation that fueled these markets might not return for years.

-

Consider vacancy rates: Be cautious in investor-heavy areas with rising vacancy rates and be prepared for longer wait times between tenants.

Final Takeaways: The Sunbelt’s Cooling Markets

The Sunbelt cities aren’t collapsing—they’re adjusting. As the market cools, prices are stabilizing, but demand fatigue is evident. Buyers, sellers, and investors all need to adjust their expectations and approach these markets with discipline.

By staying informed and using the checklist we outlined, you can make smarter decisions in these transitioning markets.

For more insights, watch the full video breakdown on our Discover the State YouTube channel.

FAQ Section

Q1: Is it a good time to buy in the Sunbelt in 2025?

It could be, especially if you’re seeing price reductions and longer days on market. However, make sure to factor in the higher carrying costs associated with these markets.

Q2: How do I know if my Sunbelt city is overpriced?

Look for signs like multiple price cuts, longer days on market, and vacant properties. If these are frequent, your city may be overpriced.

Q3: What should sellers do in cooling Sunbelt markets?

Sellers should adjust their pricing expectations, offer incentives, and be willing to negotiate to close the deal.

Q4: How are investors adjusting to the cooling Sunbelt markets?

Investors should shift their focus to properties that generate solid cash flow and adjust their expectations for appreciation. The speculative market is less reliable in 2025.

Q5: Are these Sunbelt cities still a good investment?

Investing in the Sunbelt now requires a more conservative approach. Cash flow should be a priority, and high-risk bets on appreciation should be avoided.

No Comments