© 2025 DiscoverTheState.com. All rights reserved. Powered by DiscoverTheState.com

HomeBuyer Behavior & Demand SignalsGeorgia Housing Crash Alert – 10 Metro Cities Where Bidding Wars Died Overnight

Georgia Housing Crash Alert – 10 Metro Cities Where Bidding Wars Died Overnight

Georgia’s housing market doesn’t feel the same in 2025—and you don’t need a headline to notice it. Open houses that

Why this market matters right now

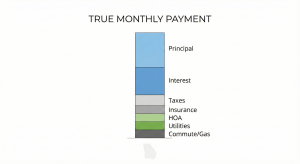

The Georgia housing crash 2025 conversation isn’t about Georgia becoming “bad.” It’s about affordability breaking the spell. Jobs, trees, schools, and Hartsfield-Jackson didn’t move. However, the monthly payment did.

In 2021, buyers bought stories. In 2025, buyers buy spreadsheets. As a result, bidding wars didn’t fade slowly. In many metros, they stopped showing up.

If you’re buying, selling, renting, or investing in Georgia, this is your advantage: you can read the shift before the headlines catch up.

Key warning signals in the Georgia housing crash 2025

When bidding wars die, you see it in behaviour first, not in vibes.

Here are the signals that matter most:

-

Days on market stretches (especially after the first two weekends).

-

Price cuts start clustering in the same neighbourhoods.

-

Seller credits come back (closing costs, repairs, rate buydowns).

-

Deals fall apart more often at inspection, appraisal, or financing.

-

List price becomes a conversation, not a command.

For the data side, build your baseline using the Redfin Data Center and weekly market updates, then sanity-check pricing trends with Zillow’s ZHVI datasets. (https://www.redfin.com/news/data-center/) (https://www.zillow.com/research/data/) <!– :contentReference[oaicite:0]{index=0} –>

Meanwhile, keep an eye on mortgage-rate direction using FRED and Freddie Mac’s PMMS releases, because rates drive the “monthly reality” more than opinions do. (https://fred.stlouisfed.org/series/MORTGAGE30US) (https://www.freddiemac.com/pmms) <!– :contentReference[oaicite:1]{index=1} –>

If you want a broader context beyond Georgia, we’ve tracked the same pattern nationally: inventory rising while buyers pause. (https://discoverthestate.com/top-10-states-where-housing-inventory-is-up-but-buyers-are-gone/) <!– :contentReference[oaicite:2]{index=2} –>

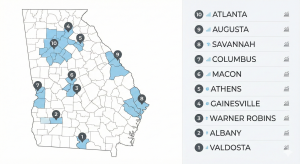

The 10 Georgia metro areas where bidding wars died overnight

Below is the countdown, starting where the cracks are easiest to spot and moving toward the “it’s always safe here” zones.

10) Augusta–Richmond County

Augusta used to clear quickly on VA/FHA demand and steady employment. In 2025, normal homes can sit through multiple weekends. Therefore, the only true “multiple offer” moments are on rare, underpriced, photo-perfect listings.

What to watch: repeat reductions on similar floorplans and seller credits quietly reappearing.

9) Columbus

Columbus can still look “cheap” on the sticker price. However, older homes plus higher insurance and higher rates can make the monthly feel heavy. As a result, first-time buyers walk faster when the payment doesn’t pencil.

What to watch: more failed pendings and more inspection-based renegotiations.

8) Macon–Warner Robins

This is where the “cheap Georgia” narrative runs into reality. Investor enthusiasm cooled, and buyers stopped waiving protections. Meanwhile, mid-tier neighbourhoods rack up price cuts instead of bidding wars.

What to watch: clusters of price cuts on the same streets and longer DOM on average-condition homes.

7) Savannah (outside trophy zones)

Savannah still has postcard demand in prime pockets. But outside trophy areas, short-term rental optimism isn’t saving mediocre deals anymore. Therefore, buyers negotiate again like adults.

What to watch: longer DOM, tougher inspection outcomes, and buyers pushing back on deferred maintenance.

If you want to compare this pattern to another high-insurance state, see our Florida breakdown where the payment stack is doing the same damage. (https://discoverthestate.com/florida-housing-market-on-the-edge-these-10-cities-are-cracking-first/) <!– :contentReference[oaicite:3]{index=3} –>

6) Douglasville / West Metro

West metro was the “more house, close enough” play. In 2021, buyers swallowed commute and gas. In 2025, that same commute plus a bigger mortgage changes behaviour fast.

What to watch: stretched buyers disappearing and sellers needing concessions to restart interest.

5) South Fulton / Union City / Fairburn

This belt was a magnet for investors and first-time buyers when deals pencilled easily. Now, buyers underwrite crime stats, schools, commute time, and payment risk. As a result, under-ask offers and longer DOM are normal.

What to watch: fewer showings, more “back on market,” and negotiated repairs becoming common again.

4) Gwinnett (Lawrenceville / Snellville / Buford slices)

Gwinnett used to be bidding-war stadium territory. But HOA dues, taxes, and the full monthly finally caught up to household budgets. Homes still sell, but they negotiate their way there.

What to watch: seller-paid closing costs and second price cuts becoming the trigger for activity.

For a related affordability lens inside Georgia, we also mapped places where locals are getting priced out. (https://discoverthestate.com/these-georgia-cities-are-now-too-expensive-for-local-buyers-in-2025/) <!– :contentReference[oaicite:4]{index=4} –>

3) Cobb + Cherokee (Kennesaw / Acworth / Woodstock areas)

“Good schools and commute” still matter here. However, the halo has slipped. What used to pull twenty offers now pulls two careful ones.

What to watch: buyers insisting on inspection, and appraisal gaps disappearing.

2) Atlanta intown non-prime belts + condos

This is where the psychology shift is loudest. Buyers are no longer fighting over parking spaces. They are underwriting HOAs, noise, crime maps, and school zones before they fall in love.

What to watch: longer DOM for condos, fewer waived contingencies, and rate buydowns replacing bidding wars.

1) North Fulton trophy arc (Alpharetta / Milton / Roswell / Johns Creek)

This is the zone people swear “never loses.” Yet jumbo loan math, rising taxes, childcare, and hybrid-work tradeoffs expose the monthly in a harsher light. Therefore, even trophy neighbourhoods can show visible price-cut clusters.

What to watch: homes sitting longer than expected, and sellers shifting from “testing the market” to “meeting the market.”

What this means for buyers

Your edge is not speed anymore. It’s discipline.

-

Target listings that have been sitting 21–45+ days, especially after a second reduction.

-

Treat list price as the opening move. Then negotiate based on days-on-market and competing inventory.

-

Keep inspection and financing protections. In addition, use inspection findings to request repair credits.

-

Ask for closing costs or a permanent rate buydown when the math needs help.

-

Run a “five-year monthly” model: mortgage + taxes + insurance + HOA + utilities + realistic repairs versus realistic rent.

If the deal only works after financial gymnastics, it doesn’t work yet.

What this means for sellers

In 2025, your competitor is not the neighbour’s 2021 closing price. It’s today’s active inventory.

-

Price to what is pending and closing now, not what used to win screenshots.

-

Consider a pre-inspection and fix obvious landmines. It reduces renegotiation risk.

-

Use incentives strategically (credits, buydowns) instead of death-by-a-thousand tiny price cuts.

-

Make your listing “clean underwriting friendly”: clear disclosures, service records, and honest condition.

If buyers trust the house, they trust the numbers faster.

What this means for investors

The new rule is simple: appreciation is not a plan. Cash-flow resilience is.

-

Underwrite insurance, HOA, and maintenance like they will rise. Because they usually do.

-

Stress-test vacancy and rent growth assumptions. Then stress-test again.

-

Avoid “thin margin” buys where one surprise repair breaks the entire year.

-

In coastal or water-risk areas, verify flood exposure early using FEMA’s tools. (https://msc.fema.gov/) <!– :contentReference[oaicite:5]{index=5} –>

If you want to compare investor-heavy pain points across states, see how similar “payment shock” patterns show up in Texas and Illinois.

-

Texas: https://discoverthestate.com/texas-housing-crash-spreads-7-overbuilt-cities-no-one-wants-to-buy-in/ <!– :contentReference[oaicite:6]{index=6} –>

-

Illinois: https://discoverthestate.com/illinois-housing-crash-deepens-8-cities-where-sellers-are-panicking/ <!– :contentReference[oaicite:7]{index=7} –>

Final takeaways

Bidding wars aren’t dead because of “vibes.” They’re dead because the payment stopped matching the story.

For buyers, that creates leverage. For sellers, it demands realism. For investors, it rewards underwriting discipline over optimism.

This article is educational and not financial, legal, or investment advice. Always do your own due diligence and consult licensed professionals.

Watch the full video breakdown on our Discover the State YouTube channel.

FAQ

Is the Georgia housing crash 2025 a real crash or just a cooldown?

In most metros, it looks more like a repricing phase than a sudden collapse. The key is behaviour: DOM, price cuts, concessions, and failed pendings.

Is it a good time to buy in Georgia in 2025?

It can be, if the monthly payment works without hero assumptions. Focus on homes sitting 21–45+ days and negotiate credits or buydowns.

What data should I watch during the Georgia housing crash 2025?

Track DOM, price-cut frequency, sale-to-list ratios, and mortgage rates. Use Redfin’s Data Center for market trends and Zillow datasets for pricing context. (https://www.redfin.com/news/data-center/) (https://www.zillow.com/research/data/) <!– :contentReference[oaicite:8]{index=8} –>

How do I know if my Georgia suburb is overpriced right now?

If similar homes keep reducing price, sit past two weekends, or require incentives to move, the market is signalling resistance. Compare active listings to recent pendings, not last year’s highs.

What should sellers do if showings are slow in 2025?

First, verify pricing versus today’s pendings. Then improve trust signals: pre-inspection, repairs, clear disclosures, and a clean incentive strategy instead of repeated tiny cuts.

Post Views: 58

No Comments