Intro: Why this market matters right now

The Illinois housing crash 2025 isn’t loud on TV. However, it’s loud in driveways. Open houses feel emptier. Listings repeat in your feed. Sellers sound “flexible” before you even ask.

In addition, Illinois is a high-tax, high-carry-cost state. So when rates rise, the monthly payment spikes faster. That’s when behavior changes first. Then prices follow.

Key warning signals in the Illinois housing crash 2025

Panic doesn’t start with foreclosures. Instead, it starts with repeatable patterns buyers can measure.

-

Days on market (DOM) stretches. Homes sit through multiple weekends.

-

Price cuts stack. One reduction turns into two. Then “motivated” language appears.

-

List-to-sale ratios soften. Offers land at or below asking, not above.

-

Concessions return. Closing credits, repairs, and rate buydowns show up again.

-

Deals fall apart more often. Inspections, appraisals, and financing kill contracts.

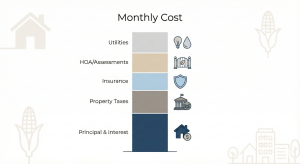

Under all of that is one pressure point: the monthly. Mortgage + taxes + insurance + utilities + HOA/assessments now have to clear real paychecks.

If you want neutral data to sanity-check your ZIP, use sources like the Redfin Data Center, Zillow Research Data, and the Fed’s 30-Year Mortgage Rate series.

Countdown: 8 Illinois cities where seller panic shows up first

These aren’t the only places under pressure. However, these eight show the clearest “behavior flip” right now.

8) Springfield

Springfield looks steady on paper. Yet steady income does not equal endless affordability. As a result, mid-tier homes can sit longer, then take the first cut sooner. If a seller anchored to 2022, they now meet a buyer anchored to the monthly.

7) Rockford

Rockford still reads “cheap.” However, older housing stock adds risk. Utilities, roofs, furnaces, and insurance checks hit hard. Therefore, buyers push for credits or walk after inspection. That’s where seller stress becomes visible.

6) Peoria

Peoria’s backbone helps. Still, the easy investor story cooled. In addition, HOA-heavy properties and older homes needing upgrades take longer to clear. When rates stay high, “fix it later” stops working as a plan.

5) Joliet + Will County

Will County was the safe upgrade story: space, tracts, commuter access. Meanwhile, commutes cost more and rates changed the math. Builders respond with incentives. Resale sellers follow, usually one step late, and that’s when listings start aging.

4) Waukegan / North Chicago corridor

Lake proximity sounds good. Yet the line items bite: taxes, HOA dues, and building maintenance. Therefore, buyers read association budgets and board minutes. Condos and townhomes often need multiple reductions before serious offers show up.

3) Naperville–Aurora condo and townhome tiers

The brand is strong. However, the total monthly is stronger. HOA dues, master insurance, and aging common elements create a ceiling. As a result, “nice on paper” listings stall unless the price resets to today’s payment reality.

2) Chicago’s non-prime condo belts

This is where the market turns “spreadsheet-first.” Buyers underwrite the building, not the granite. They ask about reserves, assessments, and HOA history. Consequently, units priced like 2021 sit, then cut, then add credits and buydowns to keep deals alive.

1) Schaumburg–Oak Brook condo and townhome corridors

This surprises people because it feels like “forever suburb.” Yet the monthly stacks fast here: taxes + HOA + utilities + upgrades on 15–25-year-old properties. As a result, inventory lingers, cuts become common, and negotiations sharpen. This is where panic feels loudest.

For related cycle context, you can compare this pattern to other state breakdowns on Discover The State, like:

What this means for buyers

Your edge is not speed. It’s structure.

-

Build a watchlist of homes sitting 21–45+ days, especially after a second cut.

-

Treat list price as an opening position, not a command.

-

Keep inspection and financing contingencies. Then negotiate from the report.

-

Ask for repair credits, closing costs, and permanent rate buydowns where it pencils.

Most importantly, run a five-year monthly. Mortgage, taxes, insurance, HOA/assessments, utilities, and obvious repairs. Compare that to realistic rent. If it only works with financial gymnastics, it doesn’t work yet.

What this means for sellers

The market won’t punish you for selling. It will punish you for denial.

-

Price to what is closing and pending now, not what a neighbor got in 2021.

-

Consider a pre-inspection to control surprises.

-

Lead with a clean incentive package early (credit, buydown, repair plan).

-

Avoid death-by-a-thousand-cuts pricing. Buyers read that as weakness.

What this means for investors

Illinois 2025 is not a lottery ticket cycle. It’s a discipline cycle.

-

Underwrite with conservative rent and real expenses.

-

Treat appreciation as upside, not your business model.

-

Stress-test taxes, insurance, HOA/assessments, and reserves.

-

If the deal doesn’t cash-flow with boring assumptions, walk.

For broader housing and pricing benchmarks, you can also track the FHFA House Price Index alongside local DOM and price-cut behavior.

Final takeaways

Illinois didn’t change overnight. The carrying cost did. Therefore, the Illinois housing crash 2025 shows up first in behavior: longer DOM, stacked cuts, and more concessions.

If you’re buying, use patience and math. If you’re selling, use pricing discipline and clean incentives. If you’re investing, demand cash flow, not hope.

This article is for educational purposes only and is not financial, tax, legal, or investment advice.

Watch the full video breakdown on our Discover the State YouTube channel.

FAQ: Illinois housing crash 2025

1) Is it a good time to buy during the Illinois housing crash 2025?

It can be, if you buy the monthly, not the story. Focus on stale listings, negotiate credits, and run the five-year monthly test.

2) How do I know if my Illinois city is overpriced in 2025?

Look for rising DOM, repeat reductions, and concessions. Then compare the monthly cost to comparable rents in the same area.

3) What should sellers do if showings are slow in Illinois right now?

Stop waiting for 2021 energy. Price to current closings, consider a pre-inspection, and offer a clear incentive package early.

4) Are Chicago condos riskier in the Illinois housing crash 2025?

They can be. HOA reserves, special assessments, and insurance costs matter as much as the unit itself. Underwrite the building first.

5) What data should I watch weekly for Illinois in 2025?

Track DOM, price cuts, list-to-sale ratio, and active inventory. Cross-check with Redfin and Zillow datasets, then validate against your ZIP.

No Comments