© 2025 DiscoverTheState.com. All rights reserved. Powered by DiscoverTheState.com

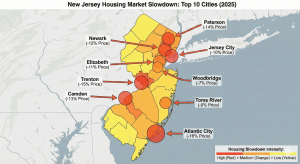

No One Is Buying Homes in These New Jersey Cities Anymore

Description text (no locations revealed): The twenty twenty five New Jersey housing slowdown is no longer a rumor you argue

New Jersey, once the go-to for commuters and those seeking proximity to Manhattan, is facing a major shift in its housing market in 2025. What was once considered a can’t-miss investment—due to its unbeatable location, elite schools, and proximity to the Shore—now looks very different. In several cities and suburbs, home listings that would have sold in a weekend are now lingering on the market. Price cuts are becoming more common, and the rising cost of ownership is quietly pushing many buyers away.

This isn’t just a passing phase—it’s a fundamental market shift. This article will take you through the top 10 New Jersey cities experiencing the most significant slowdown. We’ll break down what’s happening, the key factors driving the changes, and what it means for buyers, sellers, and investors.

Why This Market Matters

New Jersey has long been a market many people flocked to, thanks to its proximity to Manhattan and other major urban centers. With top-tier schools, cultural amenities, and access to transportation, it was seen as an ideal location for families and professionals alike. However, the factors that once fueled its housing boom are now creating significant barriers to entry for many prospective buyers.

Rising mortgage rates, skyrocketing HOA fees, increasing insurance premiums, property taxes, and ongoing utility and maintenance costs have put pressure on New Jersey’s housing market. The real question now is: How will buyers and sellers adjust to these new financial realities?

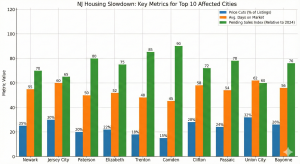

Key Warning Signals of the 2025 Slowdown

Several clear indicators point to a significant slowdown in New Jersey’s housing market. These signs are crucial for both buyers and sellers to understand the market shift and adapt accordingly.

1. Price Cuts and Longer Days on Market (DOM)

Homes are staying on the market longer than they did during the boom years. As buyers become more selective and more cautious about their monthly payments, many sellers are forced to cut prices to attract interest.

2. Rising Inventory

There’s a noticeable increase in the number of homes sitting on the market, which points to a softening demand. What was once a starved market is now shifting to one that’s merely tight.

3. Buyer Hesitation and Slipping Pendings

Pending sales are slipping as buyers reconsider their purchases due to higher total monthly costs. This slowdown is being driven by increasing mortgage rates, insurance, taxes, and HOA fees.

Countdown of the 10 New Jersey Cities Facing the Largest Slowdowns

Below, we rank the top 10 New Jersey cities where the housing market slowdown is hitting hardest. These towns and suburbs are facing the most significant drops in demand, price cuts, and rising days on market.

1. Bayonne / Union City (Condo Corridors)

Bayonne and Union City, with their prime location just outside Manhattan, were once hot spots for buyers. However, in 2025, rising HOA fees, increasing insurance premiums, and major maintenance projects like roof replacements and elevator updates have made many of these properties less affordable. Price cuts are on the rise, and concessions such as seller-paid closing credits are becoming more common.

2. Toms River / Brick (Shore Suburbs)

These shore towns have been attractive due to their proximity to the beach and access to the Garden State Parkway. However, higher insurance premiums, especially for flood-prone areas, combined with aging systems in many homes, are pushing monthly payments out of reach for many buyers. Buyers are now asking for major concessions, such as repair credits and rate buydowns, before committing to a deal.

3. Vineland / Millville (South Jersey)

South Jersey’s market is cooling due to rising costs. Wages have not kept up with the increasing property taxes, insurance, and utilities. Older homes are in need of significant updates, and many sellers are struggling to get their asking price. Buyers in this market are more cautious and are leveraging inspections to ask for repair credits.

4. New Brunswick / Edison

The university and healthcare-driven demand that once powered New Brunswick and Edison’s housing market is waning. Rising HOA fees, insurance premiums, and other carrying costs are making it harder for buyers to justify the higher prices, especially in mid- and high-rise condos. Many listings are sitting longer on the market, and concessions are becoming the norm.

5. Jersey City (Journal Square / Heights Mid-Rise Tiers)

While Jersey City is still in demand, the non-premium condos in Journal Square and the Heights are struggling. Rising HOA fees, insurance, and special assessments have pushed many properties out of reach for potential buyers. Days on market are increasing, and price cuts are becoming more frequent. Smart buyers are leveraging their position and negotiating for permanent rate buydowns and closing credits.

6. Cherry Hill / Voorhees

These suburban towns are still desirable due to good schools and proximity to Philadelphia, but rising taxes, utility costs, and property maintenance expenses are pushing monthly payments beyond what many buyers are willing to pay. Buyers are using inspection leverage to negotiate lower prices, while sellers are being forced to adjust their expectations to align with the new reality.

7. Atlantic City / Brigantine (Shore)

Atlantic City and Brigantine are still appealing to second-home buyers, but the numbers are no longer adding up. Rising insurance premiums, HOA dues, and special assessments have made many properties unaffordable for casual buyers. Sellers are increasingly offering concessions like prepaid HOA fees to bridge the affordability gap.

8. Jersey City (Non-Trophy High-Rise Tiers)

Jersey City’s mid-tier high-rise buildings, while once sought after, are now facing a slowdown due to rising carrying costs. Buyers are hesitant to purchase in buildings with increasing HOA dues, special assessments, and costly capital projects. This is leading to longer days on market and deeper price cuts as sellers struggle to adjust to the new market conditions.

9. Newark (Select Non-Prime Wards)

Newark’s market, especially in areas away from the transit-oriented zones, is feeling the strain. Rising property taxes, insurance costs, and aging infrastructure in older buildings are pushing buyers away. The market is moving slowly, with price cuts and increased days on market becoming more common.

10. Hoboken

Hoboken, long considered one of the most desirable suburbs in New Jersey due to its proximity to Manhattan, is now facing a slowdown. With rising HOA fees, higher insurance premiums, and extensive building maintenance projects, many buyers are reconsidering their options. Even though the location is prime, the rising costs are pushing many buyers out of the market.

What This Means for Buyers

For buyers, 2025 is shaping up to be a year of opportunity, but only if you are disciplined and data-driven:

-

Leverage Concessions: With rising carrying costs and price cuts, buyers can negotiate seller-paid credits, rate buydowns, and repairs.

-

Time Your Offer: Properties that have been on the market for 21 days or more are often ready for negotiation. Look for price cuts and make an offer based on the updated price.

-

Understand the True Cost: Don’t just focus on the listing price. Consider HOA fees, insurance, taxes, and potential repairs. Make sure the total monthly cost aligns with your budget.

What This Means for Sellers

Sellers in 2025 need to be strategic in order to sell in a slowing market:

-

Price Realistically: Price your property according to current market conditions. Homes that are priced too high will sit on the market.

-

Offer Concessions: Be prepared to offer buyer incentives such as closing credits or rate buydowns to help close the deal.

-

Disclose Repairs Upfront: Provide buyers with a pre-inspection report and make any necessary repairs before listing. This will increase your chances of a quick sale.

What This Means for Investors

For investors, New Jersey’s market slowdown presents both risks and opportunities:

-

Focus on Cash Flow: Look for properties that still provide strong cash flow, especially those in areas with lower carrying costs and higher rental demand.

-

Be Patient: With the slowdown, properties may take longer to sell. Be prepared for a longer holding period.

-

Reevaluate Your Portfolio: If you’re holding properties that require significant repairs or are in markets facing declining demand, it may be time to reevaluate your investments.

Final Takeaways

The New Jersey housing market in 2025 is facing a significant slowdown. Rising carrying costs, price cuts, and longer days on market are reshaping the market dynamics. Buyers, sellers, and investors need to adjust their strategies and remain disciplined to navigate this changing landscape.

FAQ Section

Q1: Is it a good time to buy in New Jersey in 2025?

It can be a good time for buyers who are prepared to negotiate and are mindful of rising carrying costs. Look for properties with price cuts and seller concessions.

Q2: How do I know if my city in New Jersey is overpriced?

If properties are sitting on the market for longer periods and price cuts are becoming more frequent, it’s a sign that the market may be overpriced.

Q3: What should I look for in a New Jersey property in 2025?

Focus on the true cost of ownership, including HOA fees, taxes, insurance, and potential repairs. Avoid properties that will push your budget beyond comfort.

Q4: What should sellers do in the New Jersey market in 2025?

Sellers should price their homes realistically and offer buyer incentives like seller-paid credits or rate buydowns to stay competitive.

Q5: How can investors navigate the New Jersey housing slowdown?

Investors should focus on properties with strong cash flow and be prepared for longer holding periods. Reevaluate properties in markets with declining demand.

Post Views: 126

No Comments