© 2025 DiscoverTheState.com. All rights reserved. Powered by DiscoverTheState.com

HomeState-Level Market BreakdownsOregon’s Housing Market Slumps — These Cities Are Facing a Price Correction

Oregon’s Housing Market Slumps — These Cities Are Facing a Price Correction

Oregon’s housing market was supposed to be the safe West Coast play—but 2025 is telling a different story. In this

Oregon’s housing market was once seen as a reliable West Coast refuge. With its charming cities, beautiful landscapes, and proximity to major West Coast metros, it seemed like a safe bet for homebuyers. However, in 2025, that story is changing. Listings are staying on the market longer, price cuts are becoming more common, and monthly payments are rising faster than buyers anticipated. If you’ve been relying on last spring’s comps, you may already be behind the curve.

In this article, we’ll explore the cities across Oregon where the housing market is showing signs of correction. We’ll take a deep dive into the data behind the slowdown—days on market, price reductions, rising inventory, and increasing carrying costs like HOA dues, insurance premiums, and utilities. With these insights, you can act strategically, whether you’re buying, selling, or investing in Oregon real estate.

Why This Market Matters

For years, Oregon’s housing market seemed impervious to volatility. Cities like Portland, Bend, and Eugene were known for their strong real estate demand, driven by a desirable lifestyle, remote work migration, and low interest rates. However, as 2025 unfolds, a number of key factors are beginning to reshape the market.

Mortgage rates have risen significantly, pushing up monthly payments for potential buyers. Insurance premiums are climbing, especially in areas prone to wildfires and floods. Property taxes and HOA dues have risen, and many cities are still grappling with the effects of inflation. This has led to a price correction in several Oregon cities, leaving both buyers and sellers with tough decisions to make.

Key Warning Signals of the 2025 Housing Slowdown

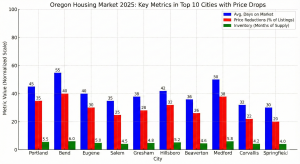

Several indicators are signaling a market correction in Oregon’s housing market. Here’s a closer look at the key warning signs to watch out for:

1. Longer Days on Market (DOM)

Homes that once sold within days are now sitting on the market for weeks, with many listings facing price cuts to attract offers.

2. Rising Inventory

Inventory has shifted from a shortage to a more balanced market, with more homes sitting unsold, making it harder for sellers to find buyers quickly.

3. More Price Reductions

Price cuts are becoming more common in several markets, indicating that sellers are struggling to meet the market’s demands and buyers’ affordability.

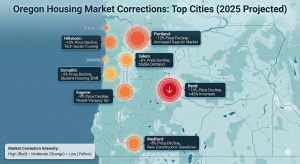

Countdown: The Top 10 Oregon Cities Facing a Price Correction

Now, let’s dive into the cities across Oregon where home prices are experiencing the steepest declines in 2025. These cities are facing longer days on market, rising inventory, and price reductions.

10. Corvallis and Albany

These university-driven markets still maintain some demand, but affordability is beginning to slip. Buyers are noticing rising costs due to aging homes needing repairs like roof replacements and HVAC updates. Sellers are seeing longer days on market, and price cuts are becoming more frequent.

9. Lincoln City and Newport

While these coastal towns are still attractive for their scenic views, the true cost of ownership is rising. Insurance rates for wind and water damage are climbing, and special assessments for necessary repairs are adding to monthly costs. Buyers are becoming more cautious and are requesting concessions like prepaid dues and rate buydowns.

8. Gresham and East Multnomah

Affordability in these areas is being pressured by rising HOA dues and the need for costly repairs in older homes. Days on market are rising, and more sellers are adjusting their prices after failing to find buyers quickly. Buyers can take advantage of this slowdown by negotiating on price and terms.

7. Salem and Keizer

Salem’s housing market is feeling the squeeze as higher property taxes and rising costs push buyers out of the market. Homes that need repairs are sitting longer, and the affordability gap is widening. Sellers must adjust their pricing to match the current market or face longer waits for offers.

6. Eugene and Springfield

Once a hot spot for remote workers, Eugene is now facing price corrections due to rising insurance premiums and the increasing costs of utilities. Buyers are starting to question whether the price is worth the monthly payment, leading to longer listing times and increased price reductions.

5. Medford and Grants Pass

These cities in the Rogue Valley are still popular for their outdoor lifestyle, but high maintenance costs are starting to discourage buyers. Many homes need significant repairs to remain competitive in the market, and sellers must offer incentives like repairs or rate buydowns to attract offers.

4. Beaverton and Hillsboro

The Silicon Forest’s proximity to Portland has been a major draw, but the rising costs of living and increasing insurance premiums are pushing some buyers away. Buyers are becoming more selective, and homes that once sold quickly are now lingering on the market.

3. Bend and Redmond

Bend’s housing market is cooling as labor and materials costs for renovations remain high. Buyers are more cautious, and many properties that need updates are seeing extended days on market. Sellers need to adjust prices to account for the rising cost of ownership in this area.

2. Portland

While Portland’s prime neighborhoods are still in demand, non-prime areas are feeling the effects of rising HOA dues and special assessments. Days on market are rising, and many sellers are cutting prices to attract buyers. Buyers in Portland are becoming more strategic, focusing on the true cost of ownership rather than just the home’s location.

1. Beaverton-Hillsboro Condo Tiers

The biggest price drops are happening in Beaverton and Hillsboro, where condo complexes are facing rising HOA dues, special assessments, and insurance premiums. Homes that once sold quickly are now sitting on the market for weeks, with price cuts becoming more common. Buyers are able to negotiate better terms, making this an opportunity for those who can wait for the right deal.

What This Means for Buyers

For buyers, Oregon’s 2025 housing market presents both challenges and opportunities:

-

Leverage the slowdown: With more listings sitting on the market, buyers have the opportunity to negotiate better deals, especially if the property has been sitting for a while.

-

Focus on the true cost: Consider all carrying costs—HOA fees, insurance, utilities, and special assessments—when evaluating a property.

-

Negotiate hard: With more concessions like rate buydowns and closing credits becoming common, buyers can secure favorable terms.

What This Means for Sellers

Sellers need to adjust their expectations in the face of rising inventory and falling prices:

-

Price realistically: Set a price based on current market conditions, not last year’s comps. Overpricing will lead to longer days on market.

-

Offer incentives: Sellers should consider offering concessions like rate buydowns or closing credits to attract buyers.

-

Be transparent: If your home needs repairs or upgrades, be upfront about it to avoid losing credibility with potential buyers.

What This Means for Investors

For investors, Oregon’s housing market slowdown presents both risks and opportunities:

-

Focus on cash flow: Look for properties with strong rental potential and steady cash flow.

-

Negotiate for better terms: With more concessions available, investors can negotiate favorable purchase terms and lower prices.

-

Evaluate long-term potential: Ensure that the property you invest in will remain profitable even in a slowing market.

Final Takeaways

Oregon’s 2025 housing market slowdown presents significant challenges for both buyers and sellers. Buyers have more negotiating power, but need to focus on the true cost of ownership. Sellers must price realistically and consider offering incentives to attract buyers. Investors need to focus on cash flow and negotiate favorable terms.

FAQ Section

Q1: Is it a good time to buy in Oregon in 2025?

Yes, if you’re patient and strategic. The market slowdown means buyers can negotiate better deals.

Q2: How do I know if my city in Oregon is overpriced?

If homes are staying on the market longer and price reductions are common, it’s a sign that the market may be overpriced.

Q3: What data should I watch in Oregon’s housing market in 2025?

Focus on days on market, price reductions, and inventory levels to gauge the market’s health.

Q4: How should sellers adjust their pricing in Oregon’s 2025 housing market?

Sellers should price their homes based on current market conditions, not last year’s prices, and offer incentives like repairs or rate buydowns.

Q5: What should investors look for in Oregon’s housing market in 2025?

Investors should focus on properties with strong cash flow potential and negotiate favorable terms.

Post Views: 103

No Comments