Why This Market Moment Matters

The U.S. states housing collapse recession is not a future theory. It is already unfolding unevenly across the country. While national headlines emphasize resilience, the lived reality for households tells a quieter story. Costs rise faster than incomes. Payments feel heavier. Decisions feel delayed.

Recessions do not begin with panic. Instead, they begin with hesitation. Buyers pause. Businesses delay hiring. Sellers wait for better conditions that never quite arrive. On paper, everything still looks functional. Underneath, pressure is already building.

Most importantly, housing stress does not hit all states at once. It concentrates where structural weaknesses already existed. Understanding where the math breaks first is how people gain time, leverage, and clarity.

Key Warning Signals Driving a U.S. States Housing Collapse Recession

The U.S. states housing collapse recession follows repeatable patterns. These forces rarely act alone. When several align, outcomes narrow quickly.

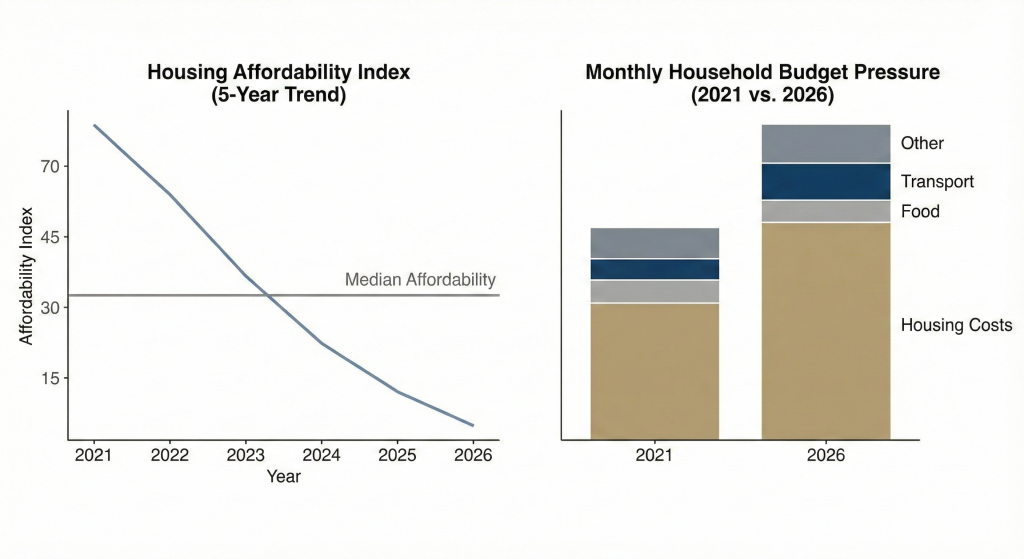

Housing affordability gaps widen when prices rise faster than wages for years. Demand does not slow gradually. It vanishes when borrowing costs rise or optimism fades.

Pension and debt strain reduce flexibility. Obligations made in good years do not shrink during downturns. Budget dollars shift from services to survival.

Federal dependence creates hidden exposure. States reliant on federal payrolls or transfers appear stable until spending tightens.

Industry concentration amplifies cycles. States tied to tourism, oil, tech, or finance rise fast and fall harder.

Population outflow is the behavioral signal most people ignore. It only takes fewer arrivals for housing oversupply to form.

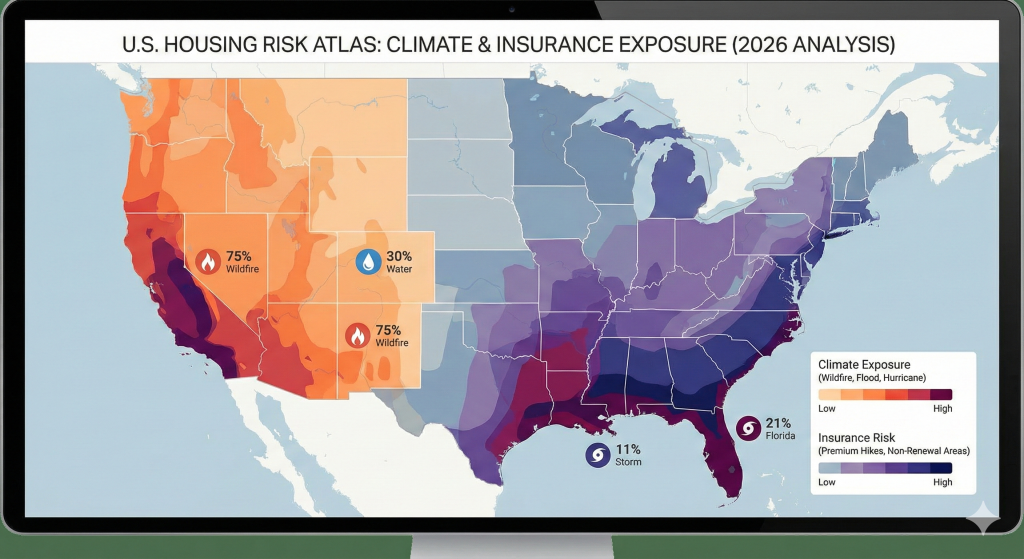

Insurance and climate exposure act like stealth taxes. Rising premiums disqualify buyers long before prices fall.

These overlapping pressures define early collapse zones.

External data sources reinforce these trends, including the Redfin Data Center, Zillow Research, and the Federal Reserve Economic Data.

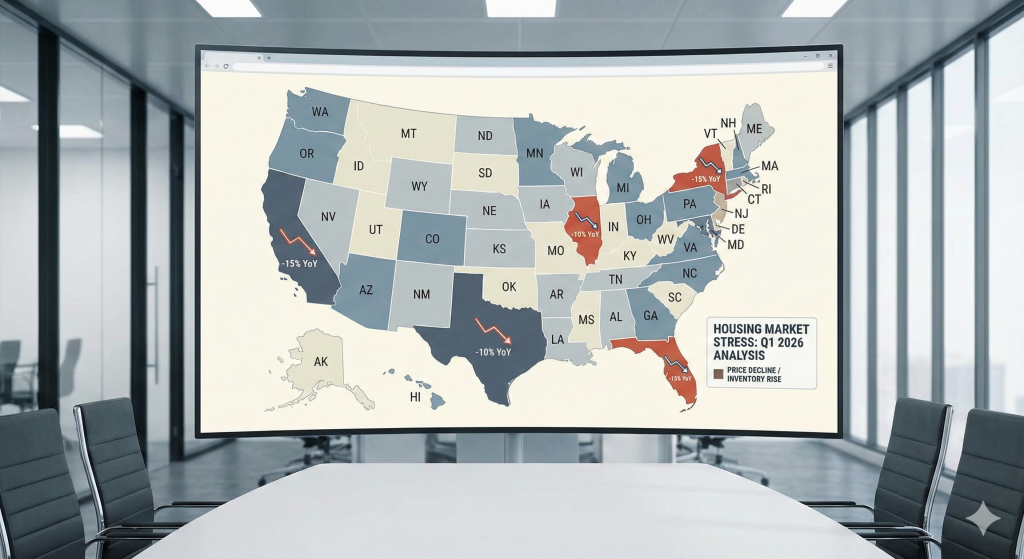

Countdown: 12 States Showing Early Structural Breakdown

12 – Colorado

Colorado still looks prosperous. However, housing costs surged far beyond local wage support. Tech hiring cooled. Commercial vacancies rose. Families recalculate rather than panic. Demand thins quietly.

11 – Mississippi

Mississippi faces exhaustion, not shock. Low incomes leave no buffer against inflation or rate hikes. Federal support masks fragility. Foreclosures rise quietly as margins disappear.

10 – Maryland

Maryland’s risk lies in federal dependency. Budget delays ripple into housing pressure. Property taxes rise while households feel squeezed. Stability here is conditional, not permanent.

9 – Delaware

Delaware’s small size magnifies stress. Corporate tax advantages fade. Pension obligations persist. Even modest job losses compress the system quickly.

8 – Alaska

Alaska’s oil dependence turns volatility into destiny. Revenue swings drain reserves fast. Population loss shows up in empty homes and stalled housing demand.

7 – New Mexico

New Mexico suffers from overlapping dependence. Federal funding and energy revenues slow simultaneously. Wages never had room to stretch. Foreclosures rise from exhaustion, not speculation.

6 – Nevada

Nevada reacts instantly to uncertainty. Tourism slows. Income drops. Housing inventory surges. Investor exits accelerate repricing, especially in Las Vegas.

5 – Louisiana

Insurance failure breaks Louisiana’s housing math. Premiums surge. Coverage disappears. Ownership becomes uncertain before prices fall.

4 – Florida

Florida’s scale no longer protects it. Insurance fractured. Migration slowed. Carrying costs exceeded tolerance. Housing weakens because ownership becomes risky, not because demand vanished.

3 – California

California faces accumulated obligation. Housing costs detached from wages years ago. Population drains. Budget gaps widen. Size delays recognition, not consequence.

2 – Illinois

Illinois is structurally constrained. Pension obligations dominate budgets. Taxes rise as residents leave. Housing appears stable until foreclosures expose persistent stress.

1 – New Jersey

New Jersey sits closest to the edge. Reserves are thin. Pension obligations loom. Property taxes and insurance erode affordability. Housing slows as confidence drains quietly.

What This Means for Buyers

For buyers, the U.S. states housing collapse recession is not a call to panic. It is a call to patience. Watch local inventory, days on market, and foreclosure filings instead of national averages.

Markets under pressure often overshoot before stabilizing.

What This Means for Sellers

Sellers face shrinking leverage. When hesitation replaces urgency, pricing must adjust. Waiting for last year’s comps often means chasing the market later.

What This Means for Investors

Investors should prioritize liquidity and resilience. Appreciation-driven assumptions weaken first in structurally stressed states.

Focus on cash flow, insurance risk, and exit flexibility. Data from the FHFA House Price Index highlights where momentum already slowed.

Internal context on similar dynamics can be found in:

Final Takeaways

The U.S. states housing collapse recession is not dramatic. It is structural. Housing stress, fiscal strain, and behavioral shifts align long before headlines change.

This article is educational, not financial or legal advice.

👉 Watch the full video breakdown on our Discover the State YouTube channel to see the full state-by-state analysis.

Frequently Asked Questions

Is the U.S. already in a housing collapse recession?

Not nationally. Stress clusters by state and city where structural weaknesses already existed.

Which states are most at risk during the recession?

New Jersey, Illinois, California, Florida, and Nevada show the strongest overlap of risk signals.

Is it a good time to buy in stressed states?

Waiting may improve leverage as inventory rises and sellers adjust expectations.

How can I tell if my state is cracking early?

Watch affordability gaps, foreclosure trends, insurance costs, and population movement.

What data should I track weekly?

Local MLS inventory, price reductions, foreclosure filings, and mortgage rate trends.

No Comments