© 2025 DiscoverTheState.com. All rights reserved. Powered by DiscoverTheState.com

HomeHousing Market Crashes & CorrectionsThese 13 States Will COLLAPSE First as USA Enters Recession | Real Estate Crisis Fully Exposed

These 13 States Will COLLAPSE First as USA Enters Recession | Real Estate Crisis Fully Exposed

America is not entering a recession the way most people expect. There won’t be one headline. One crash. One warning

Why This Housing Market Moment Matters

The U.S. states housing collapse recession narrative is widely misunderstood. Most people expect a recession to arrive with a single headline or dramatic crash. However, real housing downturns rarely unfold that way.

Instead, stress appears quietly. It shows up in foreclosure filings during “strong” job markets, inventory rising where demand weakens, and state budgets losing flexibility. By the time national averages reflect trouble, local damage is already done.

Housing does not fail evenly across the country. It fractures by state, then by city. Understanding where pressure concentrates first is the difference between reacting late and preparing early.

Key Warning Signals Behind a Housing Collapse

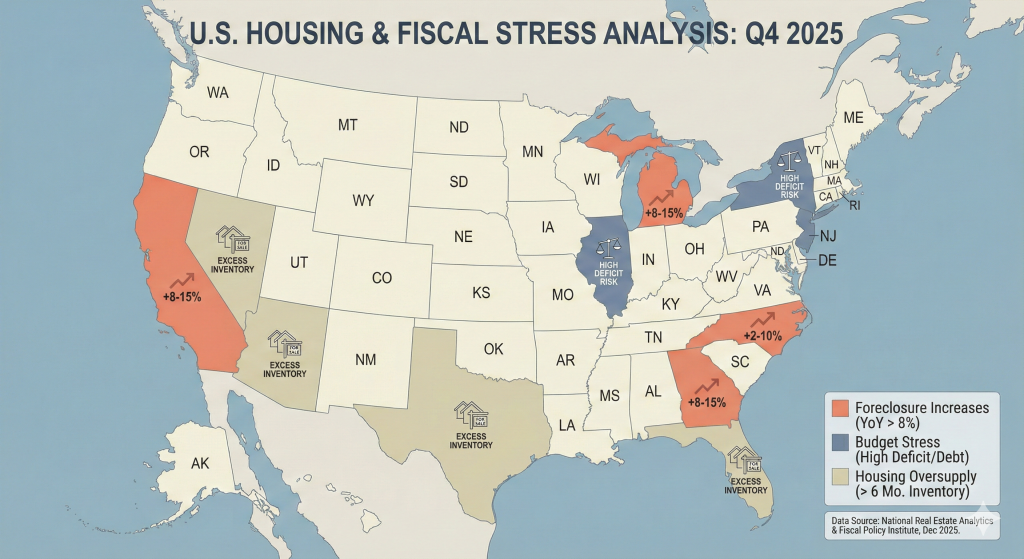

Across history, housing downturns accelerate when three forces align simultaneously. These signals define early-stage U.S. states housing collapse recession risk.

1. Rising Foreclosures During ‘Stable’ Periods

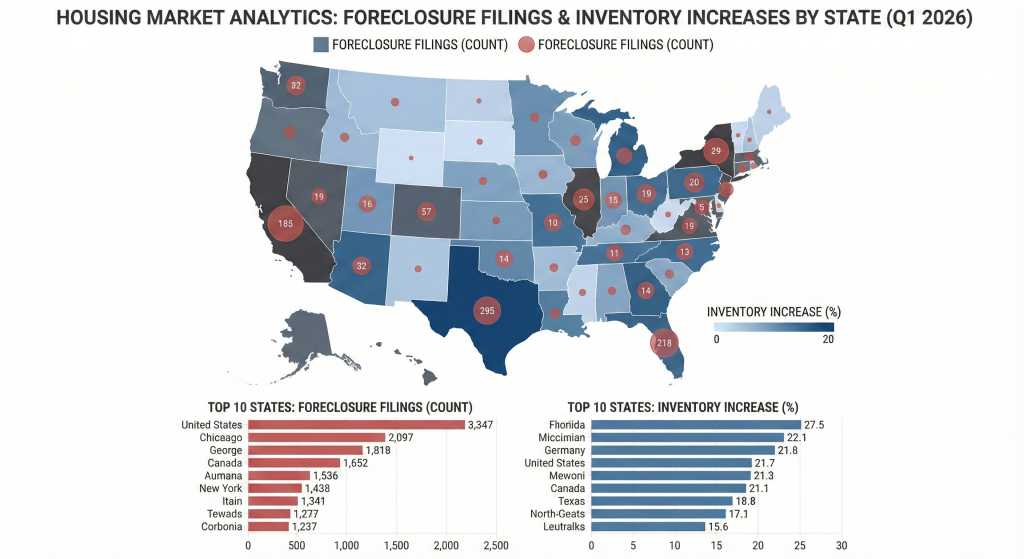

Foreclosures should be low when employment is strong. When filings rise anyway, it signals household margins are already broken. This pattern is now visible in several states, according to data from the ATTOM Foreclosure Market Report.

2. Prices Softening While Distress Increases

Falling prices alone are manageable. However, falling prices combined with rising distress create feedback loops. As equity erodes, listings increase, pushing prices lower still. Zillow’s market data shows this dynamic emerging in multiple metros (Zillow Research).

3. Weak State Fiscal Capacity

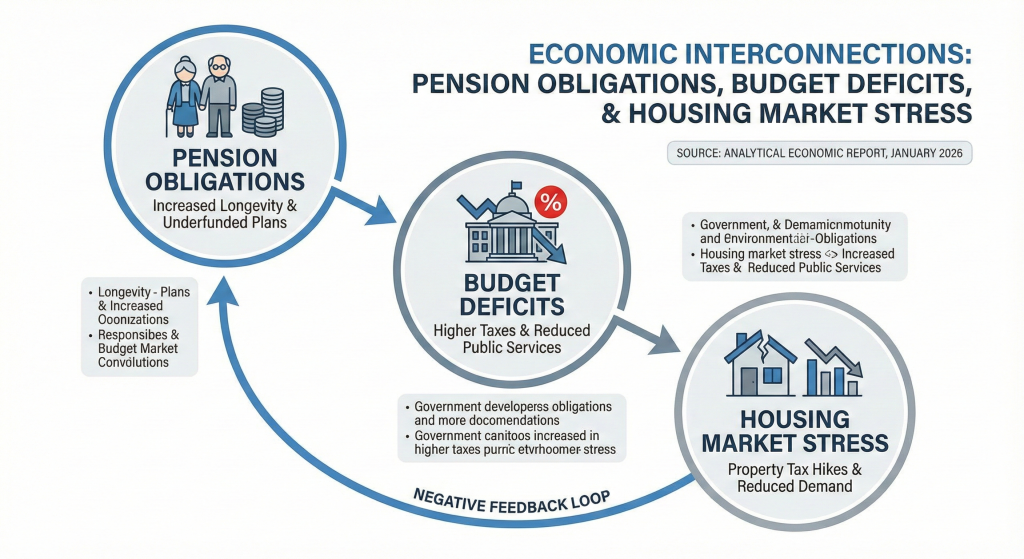

States with strained budgets, pension underfunding, or structural deficits lack the ability to stabilize housing during stress. Fiscal limits don’t cause housing downturns, but they remove every brake that could slow them. The U.S. Census Annual Survey of State Government Finances illustrates these constraints clearly.

When all three appear together, history shows recovery becomes difficult.

Countdown: States Showing Collapse-Level Stress First

13 Florida

Florida’s breakdown began with ownership costs, not pricing. Insurance premiums surged across Miami, Cape Coral, and Sarasota, forcing homeowners to sell. Meanwhile, foreclosure filings climbed and inventory rose sharply. With migration slowing, Florida’s housing engine lost momentum. For deeper context, see our analysis of Florida markets facing affordability stress.

12 Colorado

Colorado saw foreclosure filings more than double across Denver-area counties. Pandemic-era overbuilding met cooling demand and tightening state budgets. Oversupply amplified pressure, pushing prices down while distress accelerated.

11 Illinois

Illinois represents slow-motion collapse. Pension underfunding drained fiscal capacity long before housing weakened. Foreclosures remain elevated across Chicago and secondary cities, while population loss shrinks the tax base. This mirrors patterns we outlined in our Illinois housing risk breakdown.

10 South Carolina

South Carolina appears calm until foreclosure rates are stacked together. Counties around Charleston rank among the highest nationally. Limited economic diversification and modest state budgets restrict intervention once stress spreads.

9 California

California’s risk is complex, not sudden. Budget deficits, population loss, rising unemployment, and swelling inventory interact across Los Angeles, San Bernardino, and Sacramento. Affordability failed first. Business exits now amplify housing pressure, as shown in Redfin’s migration data.

Shock States: Where Stability Can Flip Quickly

8 Delaware

Business bankruptcies surged while foreclosure rates remain among the nation’s worst. Delaware’s small size means shocks travel fast, and fiscal scale offers little buffer.

7 Nevada

Nevada’s tourism-dependent economy makes it highly sensitive to downturns elsewhere. Rising unemployment in Las Vegas and Reno preceded housing softening. Diversification remains limited.

6 Texas

Texas still feels strong, which makes it dangerous. Cities like Austin face oversupply after aggressive building. Inventory rose while absorption slowed. This is a supply problem, not a credit one, similar to trends we noted in Texas housing inventory surges.

5 New York

Commercial real estate stress arrived first. Office vacancies weakened lenders, tightening credit across the system. Population outflow compounds the issue, limiting fiscal response.

4 New Jersey

Prices have held, but foreclosure rates remain elevated. High property taxes and pension obligations stretch household budgets, revealing stress beneath surface stability.

Slow-Burn States: Where Math, Not Headlines, Wins

3 Connecticut

Demographics failed first. Younger households continue leaving, while pension obligations grow. Shrinking demand slowly erodes housing values, with little room for intervention.

2 New Jersey (Long-Term Risk)

Affordability pressures and pension liabilities create persistent stress. Even when prices hold, foreclosures rise, signaling structural strain.

1 Illinois

Illinois stands at the most advanced slow-burn stage. Population loss, pension debt, and persistent foreclosure pressure form a cycle that growth alone cannot fix.

What This Means for Buyers

For buyers, the U.S. states housing collapse recession risk is not a signal to panic. It is a call to slow down.

Watch local foreclosure trends, not national headlines. Monitor inventory relative to absorption using sources like the Redfin Data Center. Markets under pressure offer future opportunity, but only with patience and strong margins.

What This Means for Sellers

Sellers face shrinking margins in early-collapse states. Rising inventory and routine price reductions signal leverage shifting away from sellers. Timing matters more than optimism.

If listings are sitting longer and concessions increase, the market is already changing. Waiting for reassurance often means selling later at worse terms.

What This Means for Investors

Investors should stress-test assumptions. Rising vacancies, declining absorption, and weak fiscal backstops increase downside risk.

Focus on cash flow resilience, not appreciation narratives. Underwrite conservatively and monitor local foreclosure filings monthly using sources like ATTOM Data.

Final Takeaways

The U.S. states housing collapse recession is not a future event. It is an uneven process already underway. Housing stress clusters by state, accelerates quietly, and becomes obvious only after margins disappear.

This analysis is educational, not financial or legal advice. Markets reward preparation, not denial.

👉 Watch the full video breakdown on our Discover The State YouTube channel for deeper state-by-state visuals and data context.

Frequently Asked Questions

Is the U.S. housing market collapsing nationally right now?

No. Housing stress clusters by state and city. National averages hide local breakdowns already in motion.

How can I tell if my state is at risk during a recession?

Track foreclosure filings, inventory relative to sales, and state fiscal health. Rising foreclosures during “stable” times are early warnings.

Are falling home prices always bad for buyers?

Not necessarily. Price declines can create opportunity, but only if employment, credit access, and local demand remain stable.

Which data sources should I trust most?

ATTOM for foreclosures, Redfin and Zillow for pricing and inventory, and U.S. Census data for state fiscal health.

Can states recover once these signals appear?

Recovery is possible, but difficult when all three forces—distress, price pressure, and fiscal weakness—align. Timing and preparation matter most.

Post Views: 32

No Comments