Why the states that will collapse first recession 2026 matter

The next U.S. recession is not arriving with a single crash or headline. Instead, it is unfolding unevenly, state by state. That is why identifying the states that will collapse first recession 2026 matters more than watching national averages.

GDP can rise while households fall behind. Job numbers can look stable while affordability erodes. By the time official data confirms stress, the damage is already embedded locally.

This is not fear-based analysis. It is systems analysis. Some states will bend. Others will break.

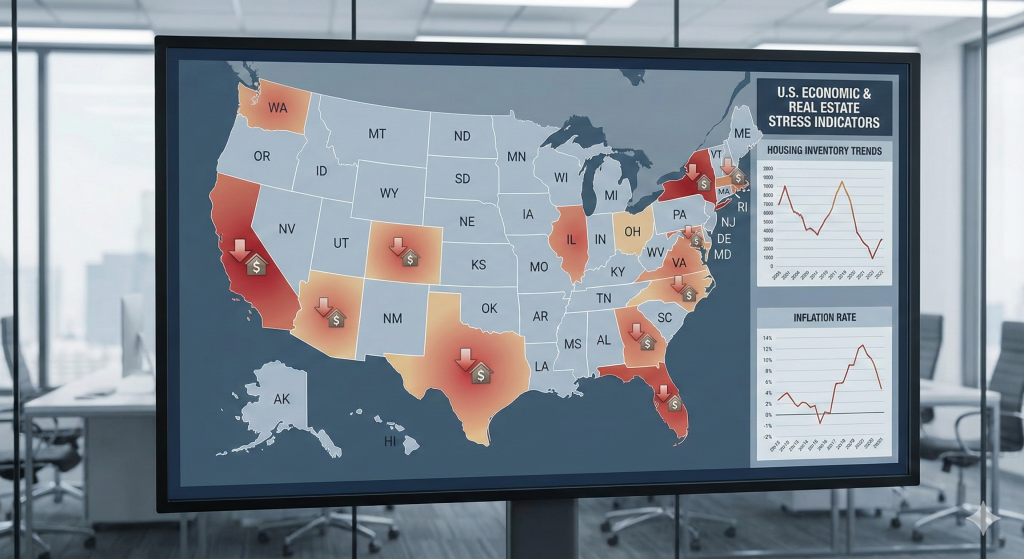

Key warning signals driving state-level collapse risk

The collapse pattern is consistent.

First, revenue shocks appear. States dependent on tourism, energy, capital gains, or sales taxes feel downturns immediately. When spending slows, revenue gaps open fast.

Second, layoffs ripple outward. Construction, tech, finance, hospitality, and energy contract early. Fewer paychecks reduce housing demand and tax receipts.

Third, fixed obligations remain. Pensions, debt service, and infrastructure costs do not fall during recessions. As a result, budgets strain.

Finally, out-migration accelerates. As services decline and costs rise, residents leave. Housing weakens. Credit ratings slip. Borrowing costs rise.

We have already seen similar dynamics in prior downturns, including the early stages of the 2008 housing collapse, documented in several Discover the State breakdowns such as the Illinois market stress analysis:

https://discoverthestate.com/illinois-housing-market-crash/

Federal debt and interest costs amplify this cycle. According to the Federal Reserve, rising rates increase fiscal pressure across state and local governments.

https://fred.stlouisfed.org

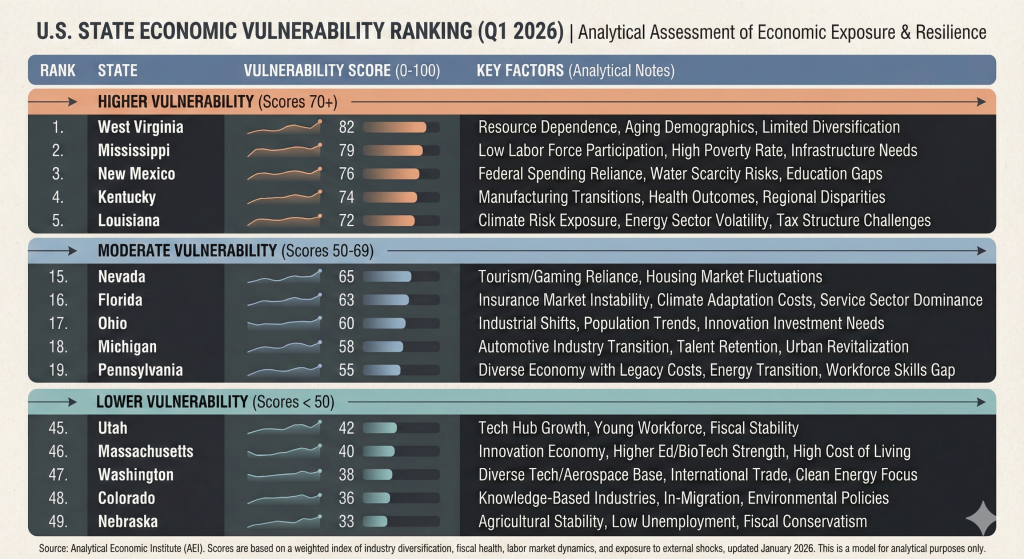

The 15 states most likely to collapse first

15 – Washington

Washington appears resilient due to tech and aerospace. However, concentration risk is high. Tech hiring slowdowns and rising housing inventory weaken tax stability.

14 – Alaska

Alaska depends heavily on oil revenue. Population loss and limited diversification leave little buffer when energy prices fall.

13 – Louisiana

Louisiana combines volatile energy exposure with high climate costs. Insurance stress and out-migration thin the tax base.

12 – Arizona

Arizona’s affordability collapse and water scarcity create long-term constraints. Population growth is already slowing as housing stress rises.

11 – New Jersey

High taxes, underfunded pensions, and steady out-migration strain the system. Housing costs remain elevated despite weakening demand.

10 – Indiana

Indiana’s manufacturing base is vulnerable to order slowdowns. Housing affordability slipped faster than wages, exposing households.

9 – Texas

Texas shows widening cracks beneath the boom narrative. Housing inventory is rising across metros, as already seen in Austin and Dallas pullbacks:

https://discoverthestate.com/texas-housing-market/

Energy volatility and infrastructure strain add risk.

8 – Nevada

Nevada’s tourism-heavy economy weakens quickly when discretionary spending falls. Housing and hospitality contract together.

7 – Hawaii

Hawaii faces extreme cost pressure, tourism dependence, and population loss. Housing sits far beyond local wages.

6 – New York

New York relies heavily on finance and commercial real estate. Office vacancies and out-migration erode tax revenue while obligations remain fixed.

5 – Delaware

Delaware’s narrow corporate tax base creates outsized risk in downturns. Small scale magnifies revenue loss.

4 – Maryland

Maryland depends heavily on federal spending. Budget tightening in Washington ripples outward quickly.

3 – Illinois

Illinois enters recession already weakened. Pension obligations, population loss, and falling commercial property values compound stress. A deeper look at this dynamic is covered here:

https://discoverthestate.com/illinois-economy-decline/

2 – California

California’s reliance on high earners, real estate transactions, and tech profits creates volatility. Business exits, wildfire insurance costs, and housing affordability amplify risk. Zillow data already shows slowing appreciation across major California metros:

https://www.zillow.com/research/data/

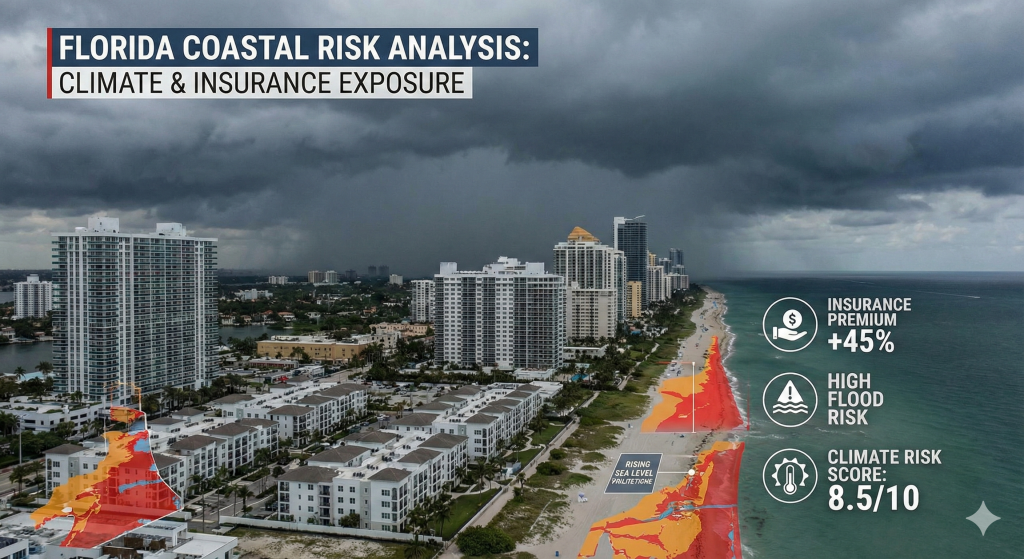

1 – Florida

Florida sits at the epicenter. Tourism dependence, housing speculation, insurance instability, and climate risk converge. FEMA flood mapping shows growing exposure across coastal counties:

https://msc.fema.gov

Florida demonstrates how collapse unfolds through multiple systems at once.

What this means for homebuyers

Buyers should evaluate states, not just cities. In the states that will collapse first recession 2026, affordability can deteriorate quickly after job losses begin.

Watch:

-

Inventory growth

-

Employment concentration

-

Insurance and tax trends

Patience often improves leverage.

What this means for sellers

Sellers in high-risk states may face shrinking buyer pools. Pricing to yesterday’s conditions increases listing time and carrying costs.

Markets lose liquidity before prices visibly fall.

What this means for investors

Investors should stress-test assumptions. Rental demand, insurance costs, and exit liquidity matter more than appreciation.

FHFA price data already shows deceleration in several vulnerable states.

https://www.fhfa.gov/DataTools/Downloads/Pages/House-Price-Index.aspx

Final takeaways on recession vulnerability

The states that will collapse first recession 2026 are not defined by politics or size. They are defined by math.

Narrow revenue streams, high fixed obligations, housing stretched beyond wages, and climate exposure create fragility. Recognizing these signals early preserves options.

This article is for educational purposes only and not financial or legal advice.

👉 Watch the full video breakdown on our Discover the State YouTube channel for deeper state-by-state analysis.

Frequently Asked Questions

Which states are most at risk in the 2026 recession?

Florida, California, Illinois, Maryland, and New York show the highest structural vulnerability.

Is it a bad time to buy in high-risk states in 2025–2026?

It depends. Buyers should focus on job stability, insurance costs, and long-term affordability.

How do I know if my state is vulnerable to collapse?

Track migration trends, housing affordability, revenue sources, and pension obligations.

Will housing prices fall first in these states?

Housing often weakens early as layoffs and out-migration reduce demand.

What data should investors monitor most closely?

Employment concentration, inventory growth, insurance availability, and state budget gaps.

No Comments