Boomtowns Going Empty in 2025: Key Housing Market Signals

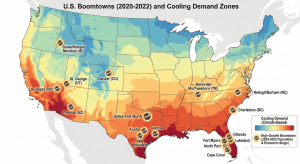

The U.S. housing market has witnessed an incredible transformation in the past few years, with some boomtowns experiencing rapid growth driven by low interest rates, the rise of remote work, and migration trends. However, as we enter 2025, many of these previously booming cities are facing an unexpected reality: demand is cooling, and homes are sitting on the market longer.

This article explores the boomtowns that are showing signs of losing their buzz. From long-forgotten price reductions to homes that remain dark at night, we’ll break down the signals of a slowing market and what it means for buyers, sellers, and investors.

Why This Market Matters

As 2025 unfolds, it becomes crucial to understand the transition from booming to quieter real estate markets. Several of the nation’s hottest boomtowns during 2020-2022 are now showing significant signs of demand exhaustion. These signs go beyond headlines and can be seen in the real behaviors of buyers, sellers, and renters.

In this context, it’s important to understand what’s happening under the surface, especially in the following boomtown archetypes. For buyers, this shift offers new opportunities; for sellers, it may signal a need for strategic pricing; and for investors, it could mean adjusting expectations.

Key Warning Signals and Data Context

A slowdown in a previously thriving boomtown doesn’t happen overnight. It often starts with subtle signs that grow more pronounced. These indicators include:

-

Longer days on market: Homes that used to sell in a weekend now sit for weeks.

-

Repeated price cuts: Sellers are reducing prices multiple times, a red flag that the original price was too optimistic.

-

Vacancy and concessions: In some areas, builders are offering incentives like free months of rent or closing-cost credits to keep occupancy up.

These shifts signal that the market is no longer behaving as it did during the boom years. Let’s explore how this looks in practice.

Nine Boomtown Archetypes Where Demand is Cooling Fast

Below are nine boomtown types where demand is significantly cooling in 2025:

1. Remote Work Relocation Hubs

Once, these cities promised large homes and low prices for those escaping urban areas. But as the novelty of remote work wears off, people are questioning the long-term viability of such distant locations. The real costs of commuting, rising utilities, and local wage stagnation are making these areas less attractive.

2. Logistics Hubs with Single-Anchor Economies

Cities that relied on a single employer or industry (such as logistics hubs or manufacturing towns) are feeling the pinch as hiring slows and wages stagnate. The once-promised “steady job market” now looks less certain, causing demand for homes to fall.

3. Sun Belt Lifestyle Cities

The promise of affordable housing, low taxes, and warm weather was attractive in the early 2020s. But as interest rates rise, the numbers don’t add up. Buyers are starting to recognize that they’re paying more for homes than what the local wages and economy can support.

4. Healthcare and Education Hubs

Smaller towns built around one or two major hospitals or universities are seeing a similar issue. When the economic engine of these places slows, so does housing demand. Once seen as solid investments, these towns are now experiencing empty streets and fewer offers.

5. Mountain and Desert Communities

Communities that sold themselves on scenic views, outdoor lifestyles, and tax advantages are seeing their appeal wane. The allure of wide-open spaces is still there, but buyers are starting to realize the true costs of living in these areas.

What This Means for Buyers

For buyers, this is an opportunity to get into markets that are no longer as competitive. Homes that once had multiple offers within days are now sitting on the market, giving you more time to make decisions. However, you’ll need to approach the market with a clear strategy:

-

Look for reduced-price homes: Be strategic in evaluating homes that have been sitting on the market for weeks or months.

-

Factor in ongoing costs: With higher interest rates and increased living costs, ensure the home you purchase fits your long-term financial strategy.

What This Means for Sellers

For sellers in these cooling markets, the key is to avoid overpricing. Listing too high could result in stagnant sales, while underpricing could leave money on the table. Here are some strategies:

-

Price aggressively but realistically: Price your home competitively within the context of your current market conditions.

-

Offer incentives: Provide value through closing-cost assistance or flexible terms to attract serious buyers.

What This Means for Investors

Investors must reconsider the aggressive assumptions that fueled their investments during the boom years. With fewer buyers willing to stretch, conservative underwriting is more important than ever. Prioritize properties with strong cash flow potential and avoid areas that relied heavily on speculative growth.

Final Takeaways: Understanding Boomtown Slowdowns

As demand cools in many of the previously hottest boomtowns, it’s essential to take a disciplined approach whether you’re buying, selling, or investing. The key is recognizing the signs early and adjusting your strategy accordingly. This isn’t about doom and gloom—it’s a market reset. By staying informed and grounded in the numbers, you can navigate these changes effectively.

For more insights into the 2025 housing market, watch the full video breakdown on our Discover the State YouTube channel.

FAQ Section

Q1: Is it a good time to buy in a boomtown in 2025?

It depends on your local market. If you’re in a city with long days on market and frequent price cuts, it may be a good time to buy, especially if you can negotiate down from the asking price.

Q2: How do I know if my city is overpriced?

Watch for price reductions, longer days on market, and concessions like closing-cost help. If these are happening frequently, your city might be overpriced.

Q3: What should sellers do in a slowing boomtown market?

Sellers should price their homes competitively, offer incentives, and avoid holding out for unrealistic prices from the boom years.

Q4: Are investors still buying in boomtowns in 2025?

Many investors are shifting focus to cash-flow-positive properties in markets with sustainable demand. It’s crucial to use conservative underwriting and avoid markets reliant on speculative growth.

Q5: How can I spot a boomtown slowdown early?

Key signs include long days on market, repeated price reductions, and vacant homes that don’t seem to sell. Monitoring these can give you a head start in understanding market shifts.

No Comments