Why the Florida Condo Market Matters Right Now

Florida condos still look attractive on the surface.

Sunshine, water views, and lifestyle appeal remain intact.

However, Florida condo prices crashing 2025 is not about aesthetics.

It is about math.

Insurance resets, rising HOA fees, and post-Surfside regulations are quietly changing buyer behavior. As a result, liquidity is breaking before headlines react. Condos tend to show stress before single-family homes, and Florida is the clearest example.

Key Warning Signals Behind Florida Condo Prices Crashing 2025

Several signals appear consistently across Florida markets.

First, insurance costs have reset higher. Condo associations insure entire buildings. When premiums spike or carriers leave, costs are divided across owners immediately.

Second, HOA reserves and special assessments are no longer optional. Structural inspections and reserve studies forced decades of deferred maintenance into the present. Thousands—or tens of thousands—per unit is no longer rare.

Third, buyer behavior has shifted. Buyers are not panicking. Instead, they are recalculating. When uncertainty rises, buyers pause. When buyers pause, liquidity disappears.

This is why Florida condo prices crashing 2025 is unfolding quietly, not emotionally.

For broader context, see our breakdown of Florida-wide housing risks:

https://discoverthestate.com/florida-housing-market-risk/

Why Condos Break Before Houses

Condos are shared financial systems disguised as simple ownership.

In strong markets, this structure feels invisible.

In tightening markets, pooled risk amplifies stress.

• HOA dues can rise without owner control

• Special assessments arrive on fixed timelines

• Insurance risk cannot be opted out of

As a result, buyers demand predictability. When predictability disappears, prices soften even in desirable locations.

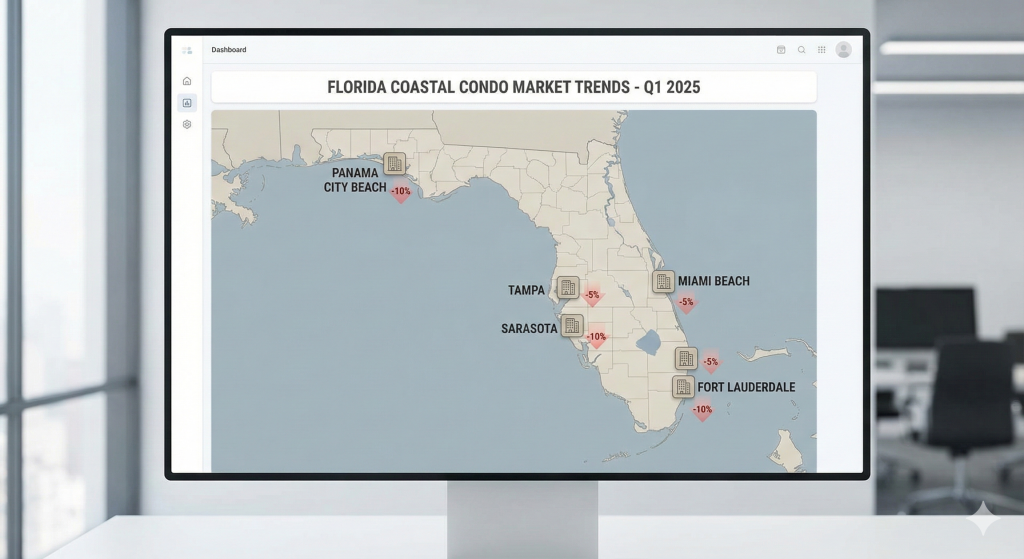

Top 10 Florida Cities Where Condo Prices Are Crashing 2025

10. Clearwater

Listings linger longer as aging buildings collide with new insurance math. Buyers hesitate after HOA document reviews. Price cuts appear quietly.

9. Fort Myers

Storm exposure amplifies insurance uncertainty. Buyers imagine future premiums instead of present views. Inventory accumulates slowly, which increases risk.

8. Daytona Beach

Investor math breaks first. Rental margins shrink as expenses rise. Relisted units and incentives replace bidding wars.

7. St. Petersburg (Non-Trophy Corridors)

Walkability still attracts interest. However, rising reserves and assessments dissolve deals after document review.

6. Hollywood, Florida

Flood exposure and aging towers converge. Buyers scrutinize concrete restoration and insurance renewals. Reductions cluster quietly.

5. Miami (Non-Luxury Condos)

Liquidity fades before confidence. Appraisal gaps widen. Investors step back, leaving owner-sellers exposed.

4. Tampa (Older Coastal Stock)

Reserve studies rewrite HOA budgets overnight. Listings relaunch after failed contracts. Prices fall through exhaustion.

3. Fort Lauderdale (Mid-Tier High-Rises)

Demand thins. Open houses empty. Units negotiate multiple times or fail entirely. Liquidity loss spreads building by building.

2. Naples (Non-Luxury Segment)

Cash buyers grow selective. Financed buyers fail late-stage math. Price cuts cluster within the same buildings.

1. Miami Beach

Miami Beach explains everything.

Insurance pressure, Surfside regulations, and HOA realities converge. Listings stack. Investors exit first. Liquidity thins despite global demand.

What This Means for Buyers

For buyers, Florida condo prices crashing 2025 creates leverage—but only with discipline.

Review HOA documents carefully.

Model insurance increases conservatively.

Assume assessments, not best-case scenarios.

Walking away is no longer failure. It is protection.

Helpful data sources include:

• Redfin Data Center – https://www.redfin.com/news/data-center/

• Zillow Home Value Index – https://www.zillow.com/research/data/

• FEMA Flood Maps – https://msc.fema.gov/

What This Means for Sellers

For sellers, belief alone no longer carries value.

Transparency matters more than staging.

Flexibility matters more than past comps.

Timing matters more than emotion.

Markets punish denial quietly. Listings do not vanish—they stagnate.

What This Means for Investors

Condos relying on stable assumptions now carry structural risk.

Cash flow breaks first.

Exit risk follows.

Investors should demand higher risk premiums or step aside entirely. Florida is a leading indicator for other HOA-heavy markets nationwide.

For similar patterns elsewhere, see:

https://discoverthestate.com/coastal-housing-markets-risk/

Final Takeaways

Florida condo prices crashing 2025 is not a crash story.

It is a repricing story.

Desirability remains. Predictability does not.

Florida broke first because insurance exposure, regulation, and shared risk converged faster here than anywhere else. Other coastal and HOA-driven markets are watching closely.

This content is for educational purposes only and not financial or legal advice.

👉 Watch the full video breakdown on our Discover the State YouTube channel to see the data and city-by-city visuals behind this analysis.

FAQ: Florida Condo Prices Crashing 2025

Is it a good time to buy Florida condos in 2025?

It depends. Buyers with strong reserves and long timelines may find opportunity. Speculative buyers face elevated risk.

Why are Florida condo prices crashing before houses?

Condos expose shared financial risk faster through HOA fees, insurance resets, and assessments.

Which Florida city is the biggest warning sign?

Miami Beach. If liquidity struggles there, it signals structural stress, not local weakness.

What data should buyers watch most closely?

HOA budgets, reserve studies, insurance renewals, and days on market.

Will this spread beyond Florida?

Yes. Shared-risk housing markets nationwide often follow Florida’s lead.

No Comments