© 2025 DiscoverTheState.com. All rights reserved. Powered by DiscoverTheState.com

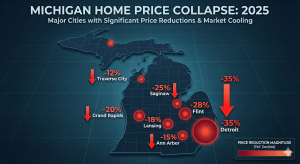

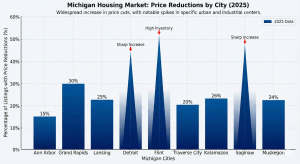

Top 10 Michigan Cities Where Home Prices Are Collapsing in 2025

In this video, we break down 10 Michigan cities where home prices are quietly collapsing in 2025, using real market

The Michigan housing market is showing signs of strain, and if you’re paying attention, you’ll see it clearly. Listings that used to disappear in days are now lingering on the market for weeks, and price reductions are becoming common. While the state’s real estate market may not be in full-blown collapse, it is going through a correction, with home prices beginning to fall in some key cities.

This isn’t just about cooling markets—it’s a shift in the power dynamic between buyers, sellers, and investors. The signs are clear: longer days on market, repeated price cuts, rising inventory, and growing concessions. For buyers, this is the moment to think strategically, not emotionally. For sellers and investors, understanding these changes can help you avoid potential regret.

Why This Market Matters

The Michigan housing market has long been seen as one of the last affordable strongholds in the Midwest. Buyers from higher-cost coastal areas, remote workers, and investors flocked here, attracted by lower prices and more space. However, 2025 is revealing that the affordability advantage is beginning to fade. With rising mortgage rates, higher insurance premiums, and stagnant wages, the math no longer works in the way it once did. As a result, demand is softening, and home prices are adjusting to match reality.

This shift is particularly important for buyers, sellers, and investors who need to understand the broader trends and where the biggest risks are. Michigan’s housing market may not be collapsing, but certain cities are quietly adjusting to a new normal. Recognizing these shifts early will allow you to act with more clarity.

Key Warning Signals and Data Context

In 2025, the Michigan housing market is seeing the following trends:

-

Price cuts stacking: Listings that once flew off the market are now having to reduce prices repeatedly.

-

Longer days on market: Homes are taking more time to sell, signaling that demand has slowed.

-

Rising inventory: More homes are available for sale, but fewer buyers are actively bidding.

-

Increasing concessions: Sellers are offering incentives like closing cost credits or rate buydowns to attract buyers.

These are not signs of a sudden crash, but rather signals that the market is adjusting. The key takeaway is that the market’s momentum has shifted, and buyers and sellers alike must adjust their expectations.

10 Michigan Cities Where Home Prices Are Collapsing

Here’s a breakdown of the 10 Michigan cities where home prices are collapsing or showing signs of a significant decline in 2025. These cities may not be in full collapse, but they are experiencing the early stages of a market correction.

1. Lansing

Lansing’s market is facing subtle but significant shifts. Homes are staying on the market longer, and price reductions are stacking up. The cause? Sellers are holding on to unrealistic price expectations while buyers are focused on today’s payments, creating a gap that isn’t being bridged.

2. Flint

Flint’s market is dealing with an affordability problem. While prices here may seem cheap compared to other cities, the buyer pool is thinning. Listings that once moved quickly are now sitting idle, forcing sellers to reduce their asking prices to match the reality of slower demand.

3. Muskegon

Muskegon, a lakeshore town, thrived on seasonal and lifestyle demand. But as interest rates rise and discretionary spending tightens, the demand has softened. Homes are lingering longer on the market, and sellers are offering incentives like price cuts and flexible terms to attract buyers.

4. Kalamazoo

Kalamazoo’s strong educational and healthcare sectors can’t protect it from the growing disconnect between home prices and local wages. Buyers here are slowing down, and listings are stacking up. Sellers are testing the market with high prices, but the market is no longer responding.

5. Grand Rapids

Grand Rapids has a solid economy, but even here, prices are starting to become unbuyable for many buyers. The gap between home prices and what locals can afford is widening, and while demand is still strong, sellers are now facing longer negotiations and rising inventory.

What This Means for Buyers

If you’re considering buying in Michigan, it’s essential to understand the current market dynamics. Price cuts are becoming more common, and homes are staying on the market longer. Here’s how buyers can navigate this:

-

Be patient: The market is adjusting, and rushing into a deal might lead to regret. Watch for homes that have been on the market for longer periods and use that as an opportunity for negotiation.

-

Focus on value: In many cities, homes that were once priced aggressively are now coming down in price. Take advantage of this correction, but be sure the property makes sense long term.

-

Leverage your position: As a buyer, you have more control now. Don’t hesitate to ask for closing cost credits or other incentives.

What This Means for Sellers

Sellers in Michigan need to adjust their expectations. It’s no longer a market where homes sell above asking price with multiple offers. Sellers should:

-

Be flexible with pricing: If your home isn’t selling, be prepared to reduce the price.

-

Offer incentives: Buyers are looking for deals. Offering closing cost credits or rate buydowns can help attract buyers in this shifting market.

-

Expect longer days on market: Don’t be surprised if your home takes longer to sell than you expected. The market has shifted, and patience is now a key factor.

What This Means for Investors

Investors should take a more cautious approach in Michigan’s housing market. The once-booming real estate scene is now cooling, and it’s essential to adjust investment strategies accordingly:

-

Prioritize cash flow: Ensure the property generates reliable income, as appreciation is no longer a guarantee.

-

Be wary of overpaying: Even in strong markets like Grand Rapids, it’s essential to focus on properties that are priced right and will deliver steady returns.

-

Consider the broader market: Michigan’s market is fragmented. Focus on local data and trends specific to each city.

Final Takeaways: Understanding the Shift in Michigan’s Housing Market

Michigan’s housing market is not in freefall, but it is undergoing a correction. Price reductions, longer days on market, and rising inventory are all signs that the market has shifted. Buyers, sellers, and investors alike must adjust their expectations and strategies to navigate this changing landscape.

For more insights into the Michigan housing market and others, check out our Michigan Housing Market Breakdown.

FAQ Section

Q1: Is it a good time to buy in Michigan in 2025?

It could be, but buyers should focus on long-term value and be patient. Look for homes that have been on the market longer and use that to negotiate a better deal.

Q2: How do I know if my city is overpriced?

Look for signs like longer days on market, repeated price cuts, and rising inventory. If homes aren’t selling quickly, the market may be overinflated.

Q3: What data should I watch in Michigan’s housing market?

Pay attention to price reductions, days on market, inventory levels, and concessions. These are key indicators that the market is shifting.

Q4: What is the best strategy for sellers in Michigan right now?

Sellers should be flexible with pricing and consider offering incentives like closing cost credits or rate buydowns. Adjust expectations as the market slows down.

Q5: How do investors navigate Michigan’s housing market in 2025?

Investors should focus on properties that provide reliable cash flow and avoid speculative deals. Ensure the property aligns with current market conditions to avoid losses.

Post Views: 30

No Comments