© 2025 DiscoverTheState.com. All rights reserved. Powered by DiscoverTheState.com

Top 10 Worst Cities to Buy a Home in California in 2026

📉 Top 10 Worst Cities to Buy a Home in California in 2026 California real estate has long been treated

Why This Market Matters Now

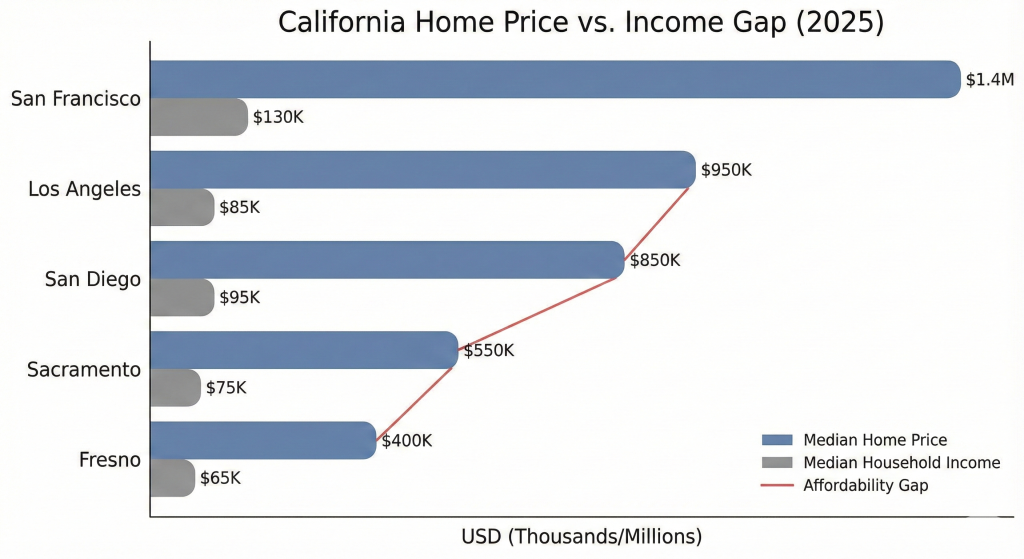

The worst cities to buy a home in California 2026 are not defined by panic or headlines. Instead, they are shaped by hesitation. Across the state, buyers are pausing, inventory is stacking, and ownership costs are quietly overwhelming wages.

California still looks strong on the surface. Jobs exist. Lifestyle appeal remains. However, beneath that image, affordability math no longer works for many households. When participation thins rather than panics, markets begin to unwind structurally.

This is not about predicting a crash. It is about identifying where flexibility, confidence, and margin have already disappeared.

Key Warning Signals Behind the Worst Cities to Buy a Home in California 2026

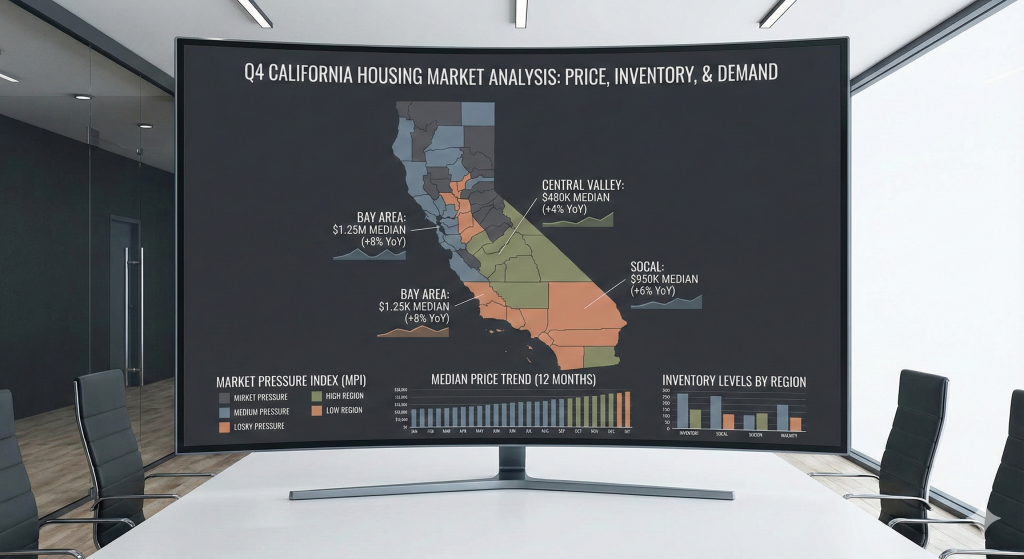

The worst cities to buy a home in California 2026 share repeating structural signals.

First, price-to-wage gaps widened for years. Buyers stretched until demand became fragile. When confidence dipped, participation slowed instead of adjusting smoothly.

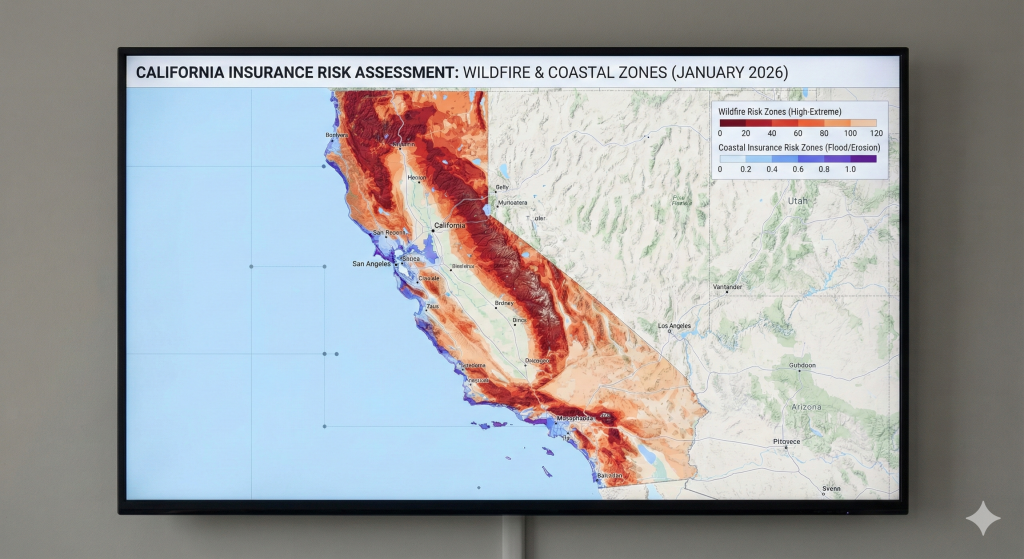

Second, insurance and climate exposure turned into stealth costs. Wildfire, flood, and heat risk pushed premiums higher or removed coverage entirely. This quietly disqualified buyers before prices moved.

Third, migration trends shifted. Inflow slowed while outflow increased modestly. That change alone builds inventory pressure over time.

Fourth, investor-heavy demand reversed quickly once appreciation slowed. Investors exit mathematically, not emotionally.

Finally, inventory growth outpaced absorption. Listings rose faster than buyers could realistically absorb them, forcing gradual repricing.

Data from sources like the Redfin Data Center, Zillow Research, and the Federal Reserve consistently reflect these patterns.

Countdown: The 10 Worst Cities to Buy a Home in California 2026

10 – Los Angeles

Los Angeles remains iconic, but affordability no longer aligns with local wages. Buyers qualify narrowly, monthly payments consume flexibility, and urgency has faded. Listings sit longer, credits replace bidding wars, and price reductions appear quietly.

9 – Oakland

Oakland faces outbound migration, rising insurance costs, and declining buyer confidence. Crime perception weighs heavier than before. Investors exit early, adding supply. Homes linger, and negotiation replaces urgency.

8 – Stockton

Stockton once absorbed overflow from coastal markets. Inflation rewrote that promise. Commutes grew expensive, wages lagged, and adjustable loans reset. Inventory builds as demand weakens, leaving a tired, fragile market.

7 – San Diego

San Diego’s lifestyle appeal masks growing stress. Investor exits, short-term rental weakness, and insurance pressure push inventory higher. Homes now wait on spreadsheets instead of emotion.

6 – Burbank

Burbank’s spillover stability is fading. Million-dollar prices, entertainment-sector uncertainty, and rising HOA and insurance costs strain buyers. Inventory accumulates slowly as belief breaks.

5 – Santa Cruz

Santa Cruz suffers from extreme price-to-income ratios and escalating insurance costs. Prestige no longer offsets carrying expenses. High-end inventory freezes before it falls, stalling momentum.

4 – Santa Barbara

Santa Barbara’s exclusivity cannot override insurance withdrawal, labor shortages, and tax pressure. Second-home demand weakens as holding costs rise. Inventory grows steadily as old price logic fails.

3 – Palm Springs

Palm Springs faces investor saturation, climate stress, and rising operating costs. As appreciation slows, investors hesitate. Listings linger, rents soften, and confidence erodes quietly.

2 – Mendocino

Mendocino’s isolation, wildfire exposure, and collapsing affordability limit buyer pools. Prestige attracts attention, but liquidity disappears. Demand freezes before prices adjust.

1 – San Francisco

San Francisco tops the list of the worst cities to buy a home in California 2026. Prestige failed to protect affordability, safety perception, and demand. Migration slowed, inventory built, and price reductions normalized. High costs without flexibility broke confidence.

What This Means for Buyers

Buyers should prioritize patience and leverage. In the worst cities to buy a home in California 2026, waiting often improves negotiating power as inventory rises and urgency fades.

Track local days on market, price reductions, and insurance availability instead of headlines.

What This Means for Sellers

Sellers face shrinking leverage. Markets driven by hesitation punish overpricing. Adjusting early preserves options, while waiting often means chasing the market later.

What This Means for Investors

Investors should focus on liquidity, insurance risk, and exit flexibility. Appreciation-driven assumptions weaken first in structurally stressed cities. Data from the FHFA House Price Index highlights where momentum already slowed.

Related DiscoverTheState breakdowns:

-

https://discoverthestate.com/california-housing-market-outlook/

-

https://discoverthestate.com/california-cities-home-prices-falling/

-

https://discoverthestate.com/san-francisco-housing-market-crash/

Final Takeaways

The worst cities to buy a home in California 2026 are not collapsing dramatically. They are losing flexibility. When affordability, insurance, migration, and investor demand align negatively, adjustment becomes unavoidable.

This article is educational, not financial or legal advice.

👉 Watch the full video breakdown on our Discover the State YouTube channel for the complete city-by-city analysis.

Frequently Asked Questions

Is 2026 a bad year to buy a home in California?

Not everywhere. Risk concentrates in cities where affordability and insurance pressures align.

Which California city is riskiest in 2026?

San Francisco shows the strongest overlap of affordability stress, migration loss, and weakening demand.

Is it better to wait before buying in these cities?

In many cases, yes. Inventory growth often improves buyer leverage over time.

What data should I watch locally?

Track price reductions, days on market, insurance availability, and migration trends.

Do California housing markets still recover long term?

Recovery depends on restoring balance between wages, costs, and demand—not reputation alone.

Post Views: 28

No Comments