© 2025 DiscoverTheState.com. All rights reserved. Powered by DiscoverTheState.com

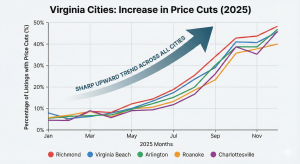

Virginia Housing Crash 2025 10 Cities Where Price Cuts Are Exploding

📉 Virginia Housing Crash 2025: 10 Cities Where Price Cuts Are Exploding Something has shifted in Virginia’s housing market—and you

The Virginia housing market is experiencing a shift in 2025. Home prices that once surged are now slowly deflating. Price cuts are becoming more frequent, listings are sitting longer, and buyer leverage is returning. While this isn’t a crash, it’s a clear correction—one that sellers, buyers, and investors can no longer ignore.

Understanding the factors behind these shifts is crucial. Buyers are now in a better position, while sellers are adjusting to a market that no longer supports the inflated prices of recent years. Let’s dive into the 10 cities in Virginia where price cuts are stacking up and buyer behavior is changing.

Why This Market Matters

Virginia, once known for its stability, is seeing its housing market slow down in 2025. For years, buyers stretched their budgets, motivated by low rates, high-paying jobs, and proximity to Washington, D.C. However, the rise in mortgage rates, coupled with growing affordability challenges, has shifted the balance. In 2025, payments are higher, and the affordability cushion has evaporated, causing hesitation rather than collapse.

This article breaks down how Virginia’s housing market is correcting, with the subtle signs that buyers and sellers need to watch. The numbers tell a story of a shift that won’t be found in the headlines but is visible in the data and the listings.

Key Warning Signals / Data Context

Several key signs indicate that Virginia’s housing market is correcting in 2025:

-

Price Cuts Stacking: What started as a few price reductions has now become more frequent, signaling that sellers are adjusting expectations.

-

Days on Market Stretching: Listings that used to sell quickly are now staying on the market longer, indicating that demand has softened.

-

Inventory Rising: More homes are available, but fewer buyers are acting, leading to a higher supply and less urgency.

-

Concessions Becoming Normal: Closing cost credits, rate buydowns, and other incentives are becoming standard, a clear sign that sellers are losing leverage.

These shifts are subtle but clear: affordability has hit a ceiling, and the buyers who remain are taking their time to make informed decisions.

10 Virginia Cities Where Price Cuts Are Exploding

Here’s a breakdown of the 10 Virginia cities where price cuts are most pronounced in 2025. These are the areas where the market is feeling the squeeze, and where you can find the best opportunities as a buyer.

1. Roanoke

Roanoke may seem stable on the surface, but look closer, and you’ll notice homes lingering on the market longer. Sellers are starting to make gradual price reductions, but they are still hesitant to drop prices significantly. The key takeaway here is patience. Buyers should wait for further price adjustments and look for homes that have been sitting for a while.

2. Lynchburg

Lynchburg has long been a “value” market, but in 2025, the market is showing signs of fatigue. Listings that once sold quickly are now stacking up, and sellers are reducing prices to try to make sales. Buyers should be cautious and focus on transaction volumes—slowing sales often precede larger price reductions.

3. Fredericksburg

Fredericksburg, a commuter city near D.C., is facing challenges as price expectations outpace local wages. Higher payments have pushed buyers back, and homes that once sold fast are now sitting. Concessions like closing credits are becoming standard, signaling that sellers are no longer in control.

4. Suffolk

Suffolk’s market is dealing with an oversupply of homes. Sellers are cutting prices to stay competitive, but the market is still seeing an excess of inventory. For buyers, this is an opportunity to negotiate and watch the inventory levels closely.

5. Newport News

Newport News is showing the classic signs of a slowing market. Listings are sitting, and when they do sell, it’s often after price reductions. Buyers in this area can benefit from patience, waiting for further price cuts and seller adjustments.

What This Means for Buyers

If you’re considering buying in Virginia, now is the time to think like an analyst. Prices are dropping, and many listings are sitting longer than expected. Here’s how you can approach the market:

-

Take your time: Don’t rush into a purchase. Many homes are sitting longer, and price cuts are becoming more common.

-

Look for concessions: Sellers are offering more incentives like closing cost credits and rate buy-downs. Take advantage of these deals.

-

Be patient: Use the current market dynamics to your advantage. Wait for sellers to adjust their expectations further, which will help you secure a better deal.

What This Means for Sellers

If you’re selling in Virginia, the market has changed. Buyers are no longer acting with urgency, and sellers must adapt. Here’s what you can do:

-

Be prepared for price cuts: Sellers who anchored their prices to 2021 trends need to adjust their expectations to meet 2025 realities.

-

Offer incentives: Be open to offering closing credits, rate buy-downs, or other incentives to attract buyers.

-

Expect longer days on market: Don’t be surprised if your home stays on the market longer than expected.

What This Means for Investors

Investors should take a more cautious approach in Virginia’s market in 2025. With price cuts, rising inventory, and softer demand, here’s how you can navigate the market:

-

Focus on cash flow: Make sure the property generates reliable income. Avoid speculative deals where appreciation is uncertain.

-

Evaluate the risk: With market conditions changing, liquidity becomes essential. Focus on properties that can withstand market slowdowns.

-

Look for opportunity in slow markets: While some areas are struggling, others remain stable. Invest strategically in areas where prices are likely to rebound.

Final Takeaways

Virginia’s housing market in 2025 isn’t collapsing, but it’s undergoing a correction. Price reductions, longer days on market, and rising inventory are all signs that the market is adjusting. Buyers, sellers, and investors must all adapt to these changes by observing market signals, being patient, and adjusting expectations.

For more insights into Virginia’s housing market and other states, visit our Virginia Housing Market Breakdown.

FAQ Section

Q1: Is it a good time to buy in Virginia in 2025?

Yes, but buyers should be patient. Look for homes that have been on the market for a while and use price reductions to negotiate better deals.

Q2: How do I know if my city is overpriced?

If homes are staying on the market longer, if there are frequent price reductions, and if inventory is rising, your city may be overpriced.

Q3: What should I look for in Virginia’s housing market?

Pay attention to price cuts, days on market, rising inventory, and increasing concessions. These are all signs that the market is adjusting.

Q4: How should I approach selling in Virginia right now?

Be prepared for price reductions and offer concessions. Be flexible with your pricing to match the current market realities.

Q5: Is it a good time to invest in Virginia real estate?

Investors should be cautious and focus on properties with strong cash flow. Avoid speculative deals, as appreciation may not be guaranteed in the short term.

Post Views: 24

No Comments